Samsung Releases 750 EVO SATA SSD

After an accidental leak in November that was spotted by our friends at Tom’s Hardware, the Samsung 750 EVO has now officially launched worldwide. Since the introduction of their first consumer TLC SSD with the 840, Samsung’s consumer/retail SATA SSD lineup has consisted of two product families: the MLC-based Pro drives, and the TLC-based 840 and EVO drives. With the 750 EVO, Samsung is creating a new budget-oriented product line that makes them a participant in the race to the bottom that they had been avoiding by positioning the 850 EVO as a mid-range SSD.

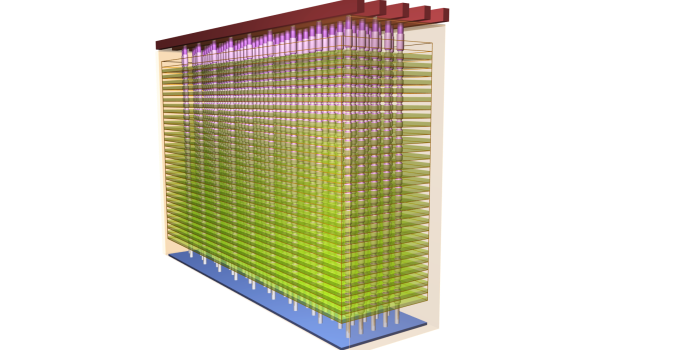

There are several design choices that help minimize the cost of the 750 EVO, aside from the expected choice of TLC over MLC. The MGX controller it borrows from the lower capacity 850 EVOs is a dual-core version of Samsung’s usual triple-core architecture. The 750 EVO will only be available in 120GB and 250GB sizes, so there won’t be any sticker shock of higher capacities and the PCB only needs to be large enough to accommodate the needs of the 250GB model. Both capacities are listed as having 256MB of DRAM, where the 850 EVO 250GB has 512MB of DRAM. But the most significant aspect of the 750 EVO is that it doesn’t use 3D NAND.

It may come as a surprise that the 750 EVO marks a return to planar NAND. Samsung has proudly led the industry in transitioning to 3D NAND, but they haven’t entirely abandoned the development of planar NAND flash. Earlier this month they made two presentations at ISSCC of their R&D accomplishments: one about a 256Gb TLC built on their 48-layer third generation V-NAND process, and one about a 128Gb MLC built on a 14nm process. The 750 EVO uses a 128Gb 16nm TLC, a larger die based on the same process as the 64Gb MLC we found in the SM951.

The 16nm TLC NAND is the successor to Samsung’s 19nm TLC that had a troubled tenure in the 840 EVO. More than a year after launch, 840 EVO owners started reporting degraded read speed when accessing old data that had not been written recently. Samsung acknowledged the issue, then provided a firmware update and Performance Restoration tool less than a month later, but had to issue a second firmware update six months after that. The 750 EVO inherits the results of all the work Samsung did to mitigate the read speed degradation, and there’s no reason to expect it to be any more susceptible than the competition using similarly dense planar TLC built on Toshiba’s 15nm process or Micron’s 16nm process.

| Samsung TLC SATA SSD Comparison | |||||

| Drive | 750 EVO 120GB | 750 EVO 250GB | 850 EVO 120GB | 850 EVO 250GB | |

| Controller | MGX | MGX | |||

| NAND | Samsung 16nm TLC | Samsung 32-layer 128Gbit TLC V-NAND | |||

| DRAM | 256MB | 256MB | 256MB | 512MB | |

| Sequential Read | 540MB/s | 540MB/s | 540MB/s | 540MB/s | |

| Sequential Write | 520MB/s | 520MB/s | 520MB/s | 520MB/s | |

| 4KB Random Read | 94K IOPS | 97K IOPS | 94K IOPS | 97K IOPS | |

| 4KB Random Write | 88K IOPS | 88K IOPS | 88K IOPS | 88K IOPS | |

| 4KB Random Read QD1 | 10K IOPS | 10K IOPS | 10K IOPS | 10K IOPS | |

| 4KB Random Write QD1 | 35K IOPS | 35K IOPS | 40K IOPS | 40K IOPS | |

| DevSleep Power | 6mW | 2mW | |||

| Slumber Power | 50mW | 50mW | |||

| Active Power (Read/Write) | 2.1W / 2.4W (Average) | 2.4W / 2.8W (Average) | Max 3.7W / 4.4W | ||

| Encryption | AES-256, TCG Opal 2.0, IEEE-1667 (eDrive) | AES-256, TCG Opal 2.0, IEEE-1667 (eDrive) | |||

| Endurance | 35TB | 70TB | 75TB | ||

| Warranty | Three years | Five years | |||

The 750 EVO’s performance specifications are almost identical to the 850 EVOs of the same capacity. The 4kB random write latency is a little bit worse, but read speeds are the same and any other differences in the write performance of the 15nm flash are masked by the SLC write cache. The reduced warranty period of three years is typical for this product segment, and while the write endurance specifications may look quite low, they’re sufficient given the capacity and intended use. It’s nice to see that the 750 EVO keeps the encryption capabilities fully enabled, as many budget drives lack hardware encryption support.

Given the aforementioned similarities with the 850 EVO, it should come as no surprise that the 750 EVO is in part a replacement. The previously announced and now imminent migration to Samsung’s 48-layer V-NAND won’t apply to the 120GB 850 EVO, as the 256Gb per die capacity would mean building a drive with only four flash chips. That is undesirable from both a performance standpoint and from a packaging standpoint—Samsung will otherwise have no reason to stack fewer than 8 dies per package.

A few online retailers are listing the 750 EVO already, albeit with limited or no stock. The MSRP of $54.99 for the 120GB model and $74.99 for the 250GB model is about $10 cheaper than what the 850 EVO is currently going for, and any sales below MSRP will make for a very competitive price.