Around a year ago DRAM manufacturers ended up pinning a lot of their hopes on DDR4 as a way to improve their profit margins. In the cutthroat and highly cyclical DRAM industry, the launch of DDR4-capable systems was seen as encouraging new sales while also serving as an opportunity to sell DRAM with higher margins, owing to the at the time substantial price premium over DDR3. Today however, the difference between prices of DDR3 and DDR4 memory is almost negligible and soon it will likely disappear entirely. What is even more important is that DRAM in general is getting cheaper, which is good for the end-user, but is not necessarily good for companies like Micron, Samsung and SK Hynix.

Prices of DRAM Memory Chips Are Down Again

The average price of one 4 Gb DDR4-2133 memory chip was $1.814 on Taiwanese spot market in late-February, according to DRAMeXchange, one of the world’s leading DRAM and NAND market trackers. This month was the first time when the spot price of one 4Gb DDR4 memory IC dropped below $2. In late December, 2015, a DDR4-2133 chip was priced at $2.221, while in late June, 2015, a similar IC cost $3.618. Overall, one DDR4-2133 chip became 18.4% cheaper in about two months and lost nearly 50% of its price in about eight months. Meanwhile the contract price of one 4 Gb DDR4 chip was $1.63 in the second half of January.

Spot prices of DDR3 memory are also dropping. One 4 Gb DDR3-1600 chip currently costs $1.807 in Taiwan, down from $1.878 in December and $2.658 in late June, 2015. It is clear that the price of DDR3 memory ICs is decreasing slower than the price of DDR4 DRAMs – leading to the impending DDR3/DDR4 price crossover point – but the trend is obvious: memory is getting cheaper. Contract price of one 4 Gb DDR3 IC was $1.59 in the second half of January.

Low prices of DRAM chips naturally influence the pricing of actual memory modules. The price of one 4 GB DDR4-2133 SO-DIMM dropped to $15.50 in the second half of January (down from $18 in December, 2015), whereas the price of one 4 GB DDR3-1600 SO-DIMM decreased to $15.25 (down from $16.75 in December, 2015).

The gap between prices of 4 Gb DDR4 and DDR3 memory ICs on the spot market is now about 7 U.S. cents, leaving DDR4 just a little more expensive than its predecessor. However, if we look at the contract price of two different 4 Gb chips, we will see that one 4 Gb DDR4 IC is an even narrower, it is only 4 U.S. cents more expensive than one 4 Gb DDR3 device. Moreover, contract prices of actual DDR4 and DDR3 4 GB DIMMs, which are used today by a lot of PC makers, are nearly the same (DDR4 is about 1.63% higher, but that is insignificant).

Retail Prices of DDR4 Modules Continue to Decline

It is evident that despite Chinese New Year, a holiday that traditionally drives prices of computer hardware a little bit up because of increased demand and paused production in China, prices of DDR4 DRAM chips and modules are still falling. Let’s take a look how that affects actual retail prices of various DDR4 and DDR3 kits in the U.S.

We’ll start things off with Kingston’s HyperX Fury Black DDR4-2133/CL14 2×8 GB kit (HX421C14FBK2/16), a pretty typical enthusiast-class memory module set. Such modules are used by both DIYers and system integrators, hence, their prices give us a good idea about where the market is going. Right now, Kingston’s kit runs for $69.94 from Amazon, according to CamelCamelCamel, which tracks prices of various items at Amazon and its partners. Just about two months ago the same DDR4-2133 HyperX Fury Black 2x8GB kit was priced at $108.99, which means that it has become 33.9% cheaper in a relatively short period of time.

Since many people these days can build relatively affordable Haswell or Skylake-based PCs, it makes sense to see how much entry-level DDR3L modules cost. Kingston introduced its HyperX Fury Low Voltage 16 GB (2*8 GB) kit (HX318LC11FBK2/16) rated to run at DDR3-1866 frequency with CL11 latency back in October at MSRP of around $96. Today, this kit costs $83.09 at Amazon.

If you are willing to take some risk and use DDR3 instead of DDR3L with Skylake, there is Kingston’s HyperX Fury Black 2×8 GB DDR3-1866/CL10 kit (HX318C10FBK2/16) available for $68.58, down from around $80 in December, 2015. Kingston also offers HyperX Savage Red 2×8 GB kit (HX321C11SRK2/16) that works in DDR3-2133 mode with faster CL11 12-12 sub-timings. The kit is available for $94.29 at Amazon and its price has not significantly changed in roughly the last half-year.

Meanwhile G.Skill’s enthusiast-class Ripjaws V DDR4-3200/CL16 2*8 GB kit (F4-3200C16D-16GVK) currently runs for $107.14 from an Amazon partner. The initial price of this Ripjaws V kit in the U.S. was $176.64 when it first hit the market in November, but it quickly dropped to $136.59 in December, knocking 22% off of its price.

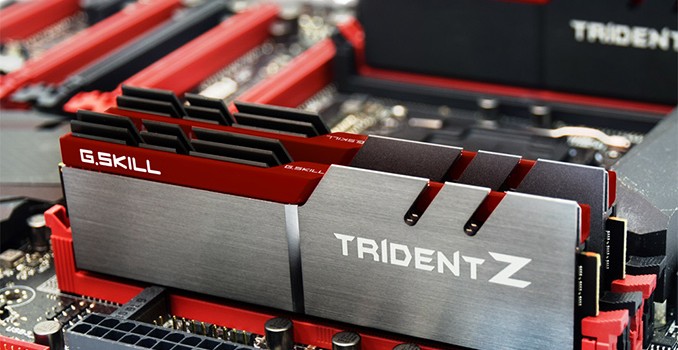

At the top-end of the performance spectrum, G.Skill’s blazing-fast TridentZ DDR4-4266/CL19 2*4 GB kit (F4-4266C19D-8GTZ) is available from an Amazon partner for $361.22 not including shipping, which is down from $460 in mid-December, 2015. Despite being a high-priced niche product, even the G.Skill Trident Z DDR-4266 8 GB kit has become around 22% cheaper in a couple of months’ time.

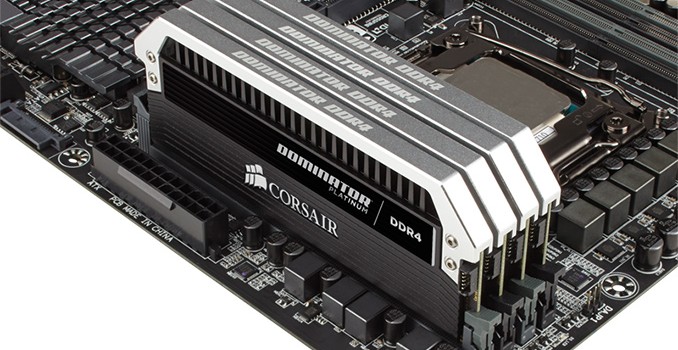

High capacity kits have also come down in price as well, though perhaps by not as much as mainstream kits. The Corsair Dominator Platinum DDR4-2666/CL15 64 GB kit (CMD64GX4M8A2666C15) was among the first 8×8 GB kits from Corsair, and was specifically designed for high-end desktops running Intel Core i7 Haswell-E processors. When it was introduced in early 2015, it cost $1759.99 at Amazon, and ended the year at $679.99. Today, this kit is priced at $539.99, a further 20.5% drop.

In fact, Corsair has quietly introduced a new version of its Dominator Platinum 64 GB DDR4-2666/C15 kit (CMD64GX4M4A2666C15) consisting of 4*16 GB modules in December. The new quad-channel kit for HEDT PCs was initially priced at $631.99, but right now, it can be acquired for $509.99, or 20% below its original December launch price.

It is obvious that retail prices of advanced non-ECC unbuffered DDR4 memory modules are dropping even faster than the prices of actual DDR4 DRAM ICs. In the last several months IC costs have continued to drop and volumes increased, while demand for all compute components in the first quarter is usually pretty low, which gives retailers like Amazon and Newegg as well as manufacturers themselves good incentive to decrease prices of their modules in a bid to keep their sales on decent levels.

What is noteworthy is that DDR3-1866 and entry-level DDR4-2133 memory modules (such as Kingston HyperX Fury) today have almost reached pricing parity. Moreover, DDR3L and higher-end DDR3-2133 kits are more expensive than DDR4-2133 kits. While DDR3 has an advantage of lower latency, it will get considerably harder and more expensive to upgrade such platforms in the future after DRAM makers reduce production of previous-generation memory.

DDR4 on Track to Become Dominant PC Memory Standard

The miniscule difference between DDR3 and DDR4 pricing indicates that supply of the latter is ramping up and is getting on par with the former. Meanwhile, due to slow demand for PCs in general and continuing shipments of PCs featuring previous-generation CPUs, demand for DDR4 is lower than supply. Nonetheless, since DDR4 is very affordable already, PC makers will gradually shift to the new type of DRAM. As a result, just as expected by companies like IHS and Intel, DDR4 should become the dominant PC memory standard in about a year from now.

Which is not to say that DDR3 will disappear overnight. Intel’s latest Skylake platforms for desktops and notebooks support DDR4, DDR3L and LPDDR3 memory (except Core M, which only support DDR3L and LPDDR3), hence, PC makers can choose which type to install based on their requirements and prices. The vast majority of advanced desktops and high-performance notebooks featuring Skylake CPUs already utilize DDR4 memory. However, a lot of mainstream desktops and notebooks were designed for DDR3 modules because it used to have a considerable price advantage. Even if the price of DDR4 chips drops below that of DDR3 chips in the next couple of months, it will hardly be worth the effort to redesign motherboards of those PCs to accomodate DDR4. Moreover, many Intel’s partners still sell systems based on CPUs featuring Haswell and Broadwell micro-architectures, which only support DDR3. According to analysts from DRAMeXchange, until PC makers clear-out their previous-generation inventory, they will continue to consume a lot of DDR3. As a result, many PCs will continue to feature the previous-gen DRAM for quite a while.

“DDR3 will still account for a large share of the PC DRAM market during the first half of 2016,” said Avril Wu, a research director at DRAMeXchange. “DDR4’s market share will not expand rapidly until the end of the second quarter, when PC OEMs finished clearing their inventories.”

As Intel ramps up shipments of its Skylake processors, more and more PCs will use DDR4. Since Intel’s code-named Kaby Lake processors are rumoured to arrive only in late 2016 or early 2017, we may see a number of mainstream laptops embracing Skylake CPUs and DDR4 memory this year.

Otherwise, from the standpoint of DRAM manufacturers, DDR4 will become the dominant type of PC-class memory already this year in terms of bits shipments. The server industry started its transition to DDR4 in Q4 2014 along with the launch of Intel Xeon Haswell-EP platform. The majority of new x86 server designs nowadays already use DDR4. Servers utilize considerably higher amounts of memory than notebooks or desktops (i.e., they consume a lot more DRAM bits than PCs), so memory makers have to produce more DDR4 memory to satisfy demands of datacenters. IHS and Intel expect crossover in DDR4 and DDR3 production to happen in 2016 and it seems like they are right in their prediction.

DRAM Supply Exceeds Demand

The impending DDR3/DDR4 crossover is being driven by softer DRAM prices overall, which in turn is a product of weaker DRAM demand and growing inventories. Worldwide PC shipments totaled 71.9 million units in the fourth quarter of 2015, a minor 2.7% increase from the third quarter and a 10.6% decline compared to the same period in 2014, according to IDC. Sales of tablets reached 65.9 million units in Q4 2015, an increase of 35.3% sequentially, but a 13.7% drop year-over-year, the researchers claim. Meanwhile, shipments of smartphones hit 399.5 million units in the fourth quarter of 2015 (up 12.4% sequentially and 5.7% YoY), setting a new record.

The vast majority of PCs and many inexpensive tablets use commodity DDR3 or DDR4 DRAM, while smartphones use more expensive LPDDR3 or LPDDR4 memory. Even though shipments of PCs and tablets in Q4 were higher than in Q3, actual DRAM industry revenue dropped by 9.1% quarter-over-quarter to $10.27 billion due to oversupply of commodity DRAM products, market analysts claim. By contrast, LPDDR revenue fell by only 1% to $4.499 billion in the fourth quarter compared to the previous quarter, according to DRAMeXchange.

Part of this drop in demands is of course seasonal, as sales of electronics are typically down in the first half of the year. For example, shipments of notebooks are expected to decline by 20% sequentially, whereas shipments of smartphones are projected to drop by around 16% quarter-over-quarter in Q1 2016. As a result, demand for DRAM is expected to be weak, which is why DRAM prices will remain under pressure. This in turn why we’re seeing actual retail prices of memory modules decline faster than the spot/contract prices of DRAM ICs.

“We expect notebook shipments to have a quarterly decline of 20% in the first quarter of 2016 on account of seasonality,” said Mr. Wu. “Therefore, DRAM manufacturers are under pressure to lower contract prices in order to digest inventory.”

Transition to Newer Fabrication Processes Pushes DRAM Prices to New Lows

There are only three major DRAM manufacturers on the planet, but the competition between them remains tough. Nobody wants to cut-down DRAM production because nobody wants to lose market share. Moreover, Samsung, SK Hynix and Micron are aggressively adopting smaller manufacturing technologies to cut down costs. As fabrication processes shrink, so do the sizes of memory cells, increasing bit output per wafer and essentially boosting DRAM output and causing prices to decline further.

Samsung began to transit its DRAM production to 20 nm fabrication technology in Q1 2014 and analysts from DRAMeXchange believe that by now their yields are very high. Meanwhile market observers anticipate Samsung will start producing memory using their 18 nm manufacturing process sometimes in the middle of 2016, which will further increase the total capacity of DRAM on the market. Smartphone manufacturers are already preparing for the jump, and DRAMeXchange claims that Xiaomi, OPPO and Vivo have already qualified Samsung’s 12Gb mono-die LPDDR4 ICs made using 18 nm technology.

Opposing Samsung, SK Hynix is gradually increasing their DRAM production using their 21 nm manufacturing technology. While the company’s plans concerning smaller processes are unclear, SK Hynix is ramping up its M14 fab (which was completed in August, 2015), which will eventually have a capacity of 200 thousand wafer starts per month. Even without introducing a new process technology, SK Hynix is increasing output of DRAM by deploying the fab. Moreover, the company has not yet started high volume production of monolithic 8 Gb DDR4 ICs on their 21nm process. Once the company kicks off mass production of such chips, their bit output will increase further and will add pressure on prices.

Finally, Micron started to produce memory chips using their 20 nm fabrication process in early 2015. Late last year the company said that they remained on-track with their conversion plan and yield targets for their 20 nm technology. In fact, according to a slide that Micron demonstrated at its Winter Analyst Conference this month, their 20 nm yields are better than their existing 25 nm yields. The Boise, Idaho-based company hopes that half of their DRAM bit output will be produced at 20nm by mid-2016. The DRAM maker also plans to increase production of high-margin memory products, including 8 Gb DDR4, 8 Gb GDDR5/GDDR5X, and LPDDR4. Micron has also publicized aggressive plans for their 16 nm manufacturing technology. The company’s fabs will be ready to start production of 16nm DRAM by September, which will further increase output provided that yield rate will be high enough.

Otherwise, as prices of commodity 4 Gb DRAM chips are declining, makers of computer memory are now pinning their hopes on LPDDR ICs, server DRAM, and graphics/specialty memory as major profit drivers. Usage of 8 Gb DRAM ICs is also growing in servers and client PCs, so there are opportunities for memory makers to earn money in the short term, however 8 Gb chips will also commoditize over time.

Samsung Remains Top DRAM Manufacturer

Thanks to its aggressive transitions to leading-edge process technologies as well as vast manufacturing capacities, Samsung has been the world’s largest DRAM manufacturer for well over a decade. It is not surprising that the company retained its leading position in Q4 2015.

Samsung’s DRAM revenue for the fourth quarter dropped to $4.762 billion, or by 9.7% sequentially, according to DRAMeXchange. The company commanded 46.4% of the global memory market and is considerably ahead of the world’s second largest DRAM maker, SK Hynix. DRAM sales of the latter declined by 9.3% quarter-over-quarter to $2.865 billion, whereas its market share remained nearly flat at 27.9%. Third place Micron’s DRAM shipments deteriorated by 10.5% and totaled $1.945 billion in Q4 2015. The company’s market revenue share also decreased to 18.9%, the analysts found. By contrast, smaller memory makers (Nanya, Powerchip and Winbond), who controlled 3.7% of DRAM market share in the fourth quarter, managed to slightly increase their shipments and share mostly thanks to specialty and industrial memory.

Samsung also shipped the lion’s share of mobile DRAM in the fourth quarter. The company’s LPDDR revenue totaled $2.619 billion, up 1.3% sequentially. Samsung in turn supplies mobile DRAM to Apple; its own mobile division, the world’s top maker of handsets; as well as rapidly growing suppliers from China.

SK Hynix remained the distant second largest manufacturer of mobile DRAM in the fourth quarter of 2015. The company’s sales of LPDDR fell to $1.175 billion from the previous quarter, whereas its revenue share dropped to 26.1%. SK Hynix is another key supplier of LPDDR4 to Apple, which is why its shipments are still very high. Finally, Micron’s mobile DRAM sales declined by 7.7% in Q4 to $642 million, its market share shrank to 14.3%, according to analysts.

Overall, DRAMeXchange expects LPDDR4 to account for 45% of mobile DRAM shipments this year, up from 18.2% in 2015. Meanwhile usage of 8 Gb DDR4 chips is also expected to increase, and if Samsung manages to kick off 18nm DRAM production in mid-2016, as analysts expect, it may again benefit from the capacity and power advantages of a leading-edge manufacturing process. Micron, in contrast, will only be ready with its 16 nm production technology in Q4 2016, so they won’t be able to capitalize on the new process until late in the year.