Today we’re launching a new feature on the AnandTech Pipeline: Quarterly HDD shipments reports. Here we’ll examine HDD sales and analyze what’s behind them. Since some numbers are estimates, we recommend you to check our counting methodology in the end of the story before reading.

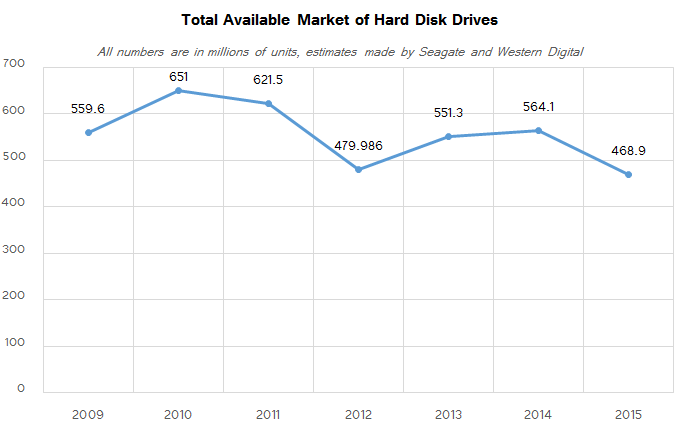

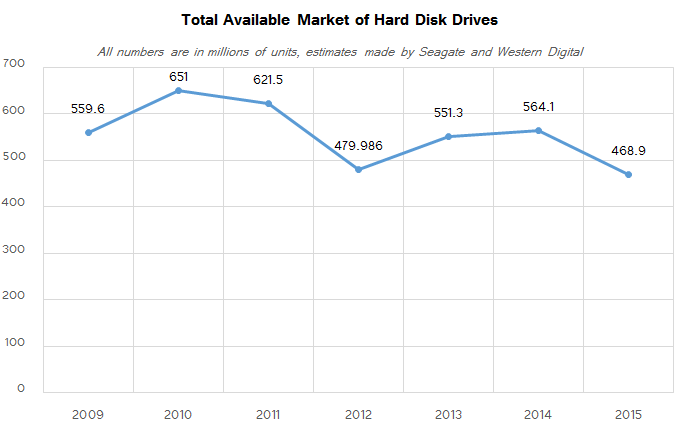

While no one is writing off the PC market entirely, since it’s heyday nearly a decade ago the PC market has been in a slow decline for some time, and that decline has yet to bottom out. Sales of personal computers declined by roughly 25 – 30 million units year-over-year, hitting an eight-year low in 2015 due to economic trends, weak international currencies, and competition from tablets and smartphones in some markets. Shipments of PC components naturally dropped alongside weak PC sales, but hard drive sales in particular have made for an interesitng observation: for 2015, declines of HDD sales greatly outpaced the regress of the PC market. Based on estimates from Western Digital and Seagate (see counting methodology below), the total available market of hard drives contracted by nearly 100 million units year-over-year in 2015.

Sales of HDDs Total 469 Million Units in 2015

The three major producers of hard drives shipped a total of 468.9 million hard drives in 2015, according to estimates from both Seagate and Western Digital. This is down from 564.1 million units in 2014, or by 17%. By comparison, back in 2010 at the peak of HDD sales, the industry sold 651 million HDDs.

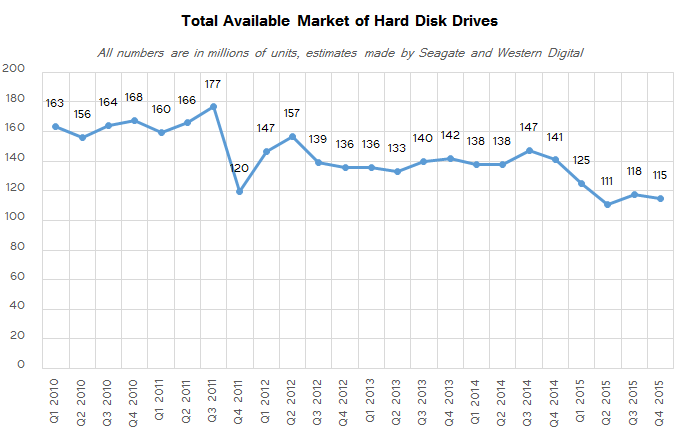

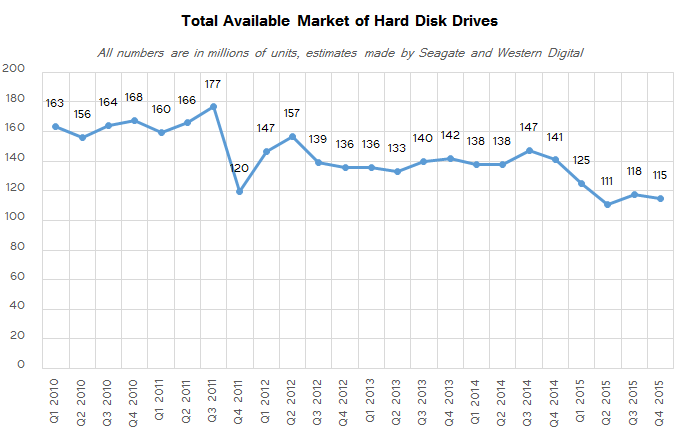

Typically, sales of HDDs are rather high in the fourth quarter. They may be slightly higher or slightly lower than in Q3, which is seasonally strong since PC makers are stockpiling components for the back-to-school and holiday seasons. Shipments of hard drives in Q4 2015 totaled 115.1 million units, which was well below shipments of HDDs in any fourth quarter of any year of this decade. In fact, even in Q4 2008, when the global economic crisis struck, the industry shipped about 124 million hard drives. Moreover, HDD TAM in Q4 2015 dropped below the levels in Q4 2011, when a devastating flood in Thailand damaged production facilities of hard drive makers.

Typically, sales of HDDs are rather high in the fourth quarter. They may be slightly higher or slightly lower than in Q3, which is seasonally strong since PC makers are stockpiling components for the back-to-school and holiday seasons. Shipments of hard drives in Q4 2015 totaled 115.1 million units, which was well below shipments of HDDs in any fourth quarter of any year of this decade. In fact, even in Q4 2008, when the global economic crisis struck, the industry shipped about 124 million hard drives. Moreover, HDD TAM in Q4 2015 dropped below the levels in Q4 2011, when a devastating flood in Thailand damaged production facilities of hard drive makers.

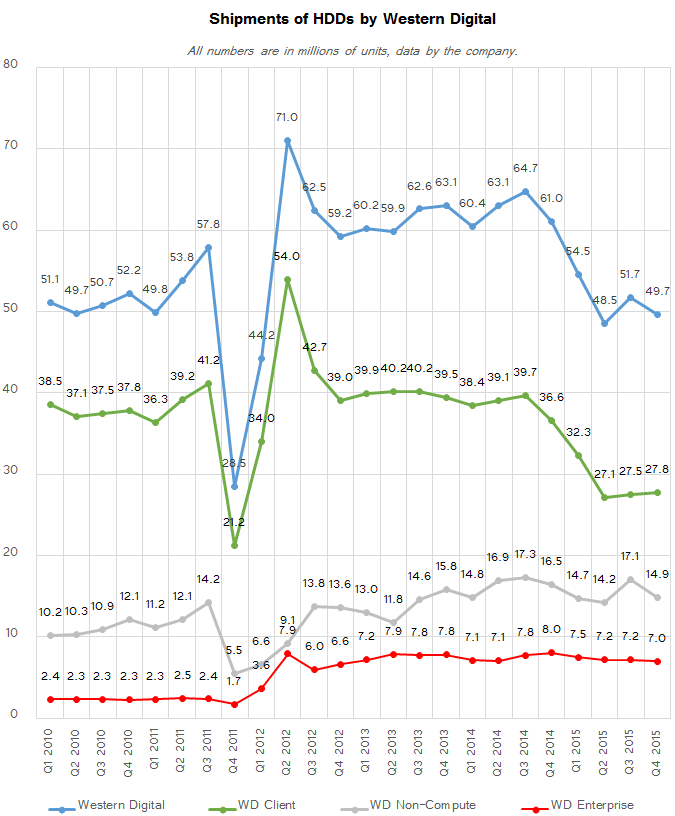

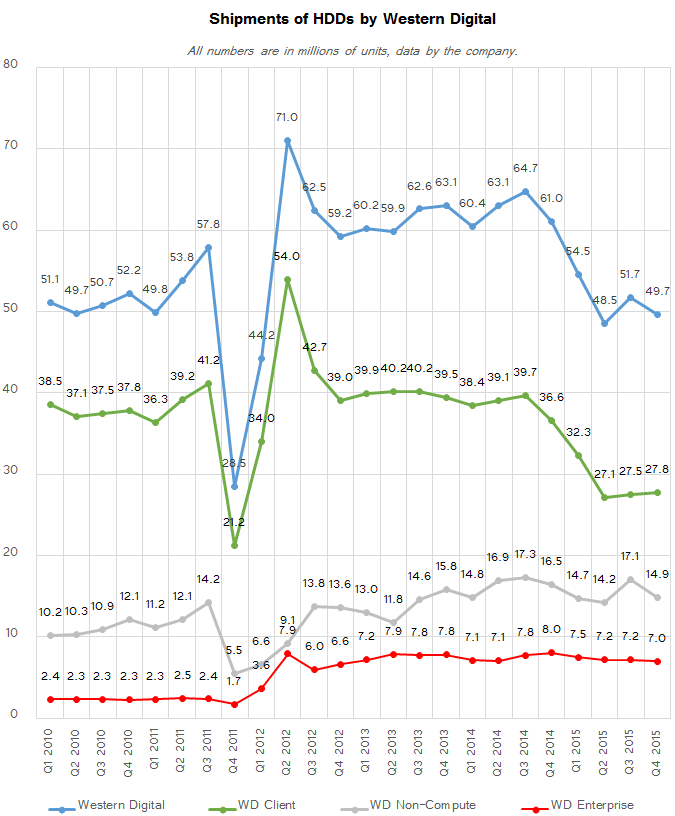

Western Digital sold 49.688 million of HDDs in Q4 2015 (a drop of 18.6% year-over-year) and said that shipments of hard drives for gaming PCs as well as for enterprise were weaker than expected. Western Digital expects total available market of HDDs to drop to 100 million units in the first quarter of 2016, which would be the lowest HDD TAM in a decade. In a bid to remain competitive and profitable in new market realities, Western Digital plans to optimize and streamline its roadmap and eliminate at least six programs to reduce costs. In addition, the company intends to close-down its head wafer manufacturing facility in Otawara, Japan. After the fab is shut down, Western Digital will have just two head wafer facilities.

“We anticipate weak demand in the March quarter, resulting in a hard drive TAM of approximately 100 million units,” said Stephen Milligan, chief executive officer of Western Digital, in a conference call with investors and financial analysts. “We are reducing our cost base through a series of planned actions, including the elimination of redundancy in functions, products, and facilities. […] We are streamlining our product roadmap by focusing our efforts to eliminate redundancy and optimize the products we offer, resulting in the elimination of a minimum of six programs.”

On an annual basis, Western Digital sold 204.46 million HDDs in 2015, a decline of 18% compared to 2014.

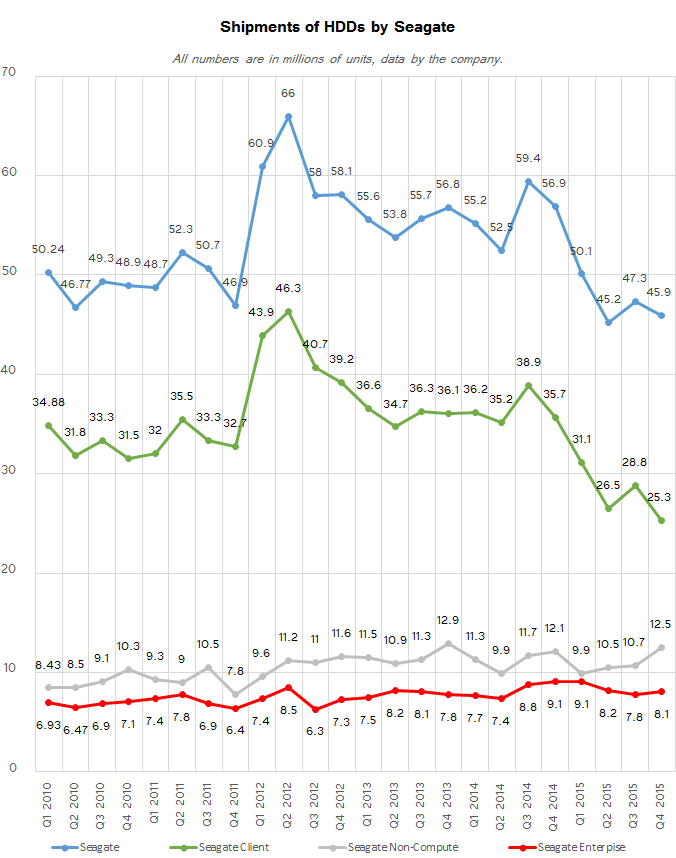

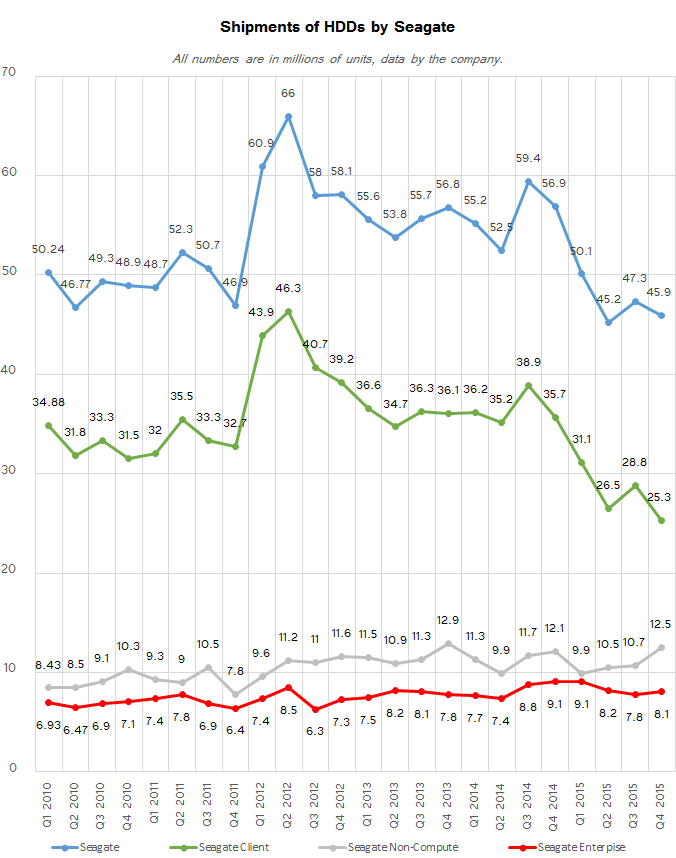

Seagate shipped 45.9 million of hard drives in Q4 2015, which was 20% below shipments in the fourth quarter of prior year primarily due to slow demand for PCs. Back in January the company said that it expected HDD market to stay weak, which is why it would perform a reorganization, optimize its internal and external supply chains, accelerate its roadmap, raise prices in certain markets and even cut-down its manufacturing capacity in a bid to stay financially healthy in the coming months.

“Taking into account macroeconomic factors, we believe overall storage market demand will be seasonally down in the March quarter which has ranged between 5% and 10% over the last five years,” said Steven Luczo, chief executive officer of Seagate, in a conference call with investors and financial analysts. “We anticipate our non-GAAP gross margins will be sequentially flat in the March quarter and ongoing activities that will improve our profitability, including raising prices in certain markets, aggressive product transitions and internal and external supply chain optimization such as reducing manufacturing capacity.”

Seagate shipped 188.5 million hard drives in 2015, down 15.9% from 224 million units in 2014.

By contrast, HDD shipments of Toshiba slightly increased in the fourth quarter compared to the Q3 2015, if the estimates are correct. When compared to the same period last year, sales of Toshiba’s hard drives declined by around 15%. The company shipped about 76 million HDDs in 2015, a decline of approximately 16% from around 91 million a year before.

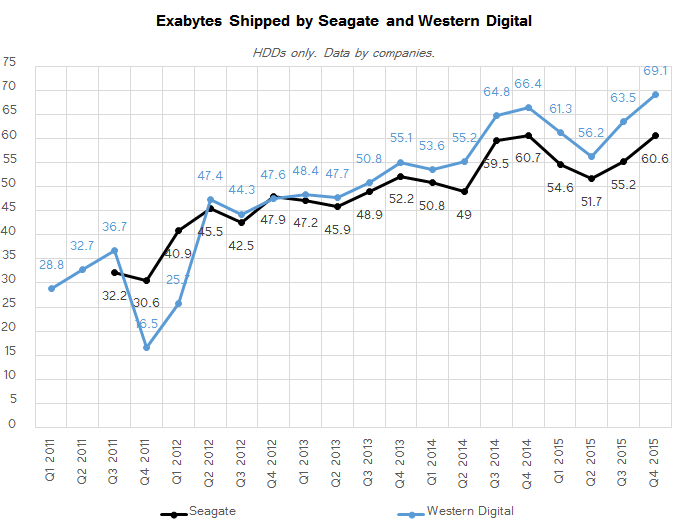

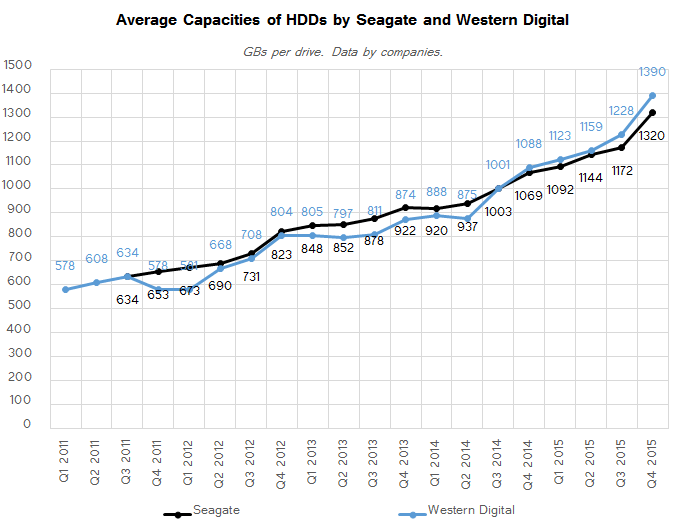

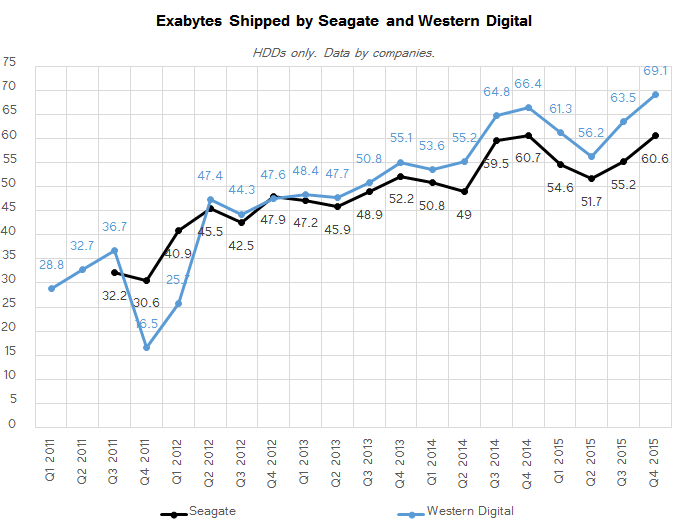

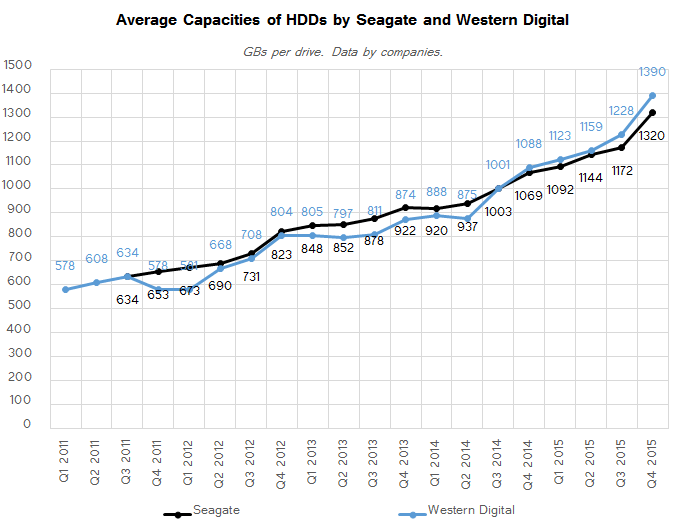

Capacity Shipped Hit Record as Average HDD Capacity Is Increasing

But while unit sales of hard drives are declining, demand for HDD storage has not. Both Seagate and Western Digital set records in terms of capacity shipments both in Q4 2015 and in for the whole year. Total capacity of Seagate’s HDDs shipped in 2013 was around 194.2 EB (Exabyte), but total capacity of hard drives the company sold in 2015 was 222.1 EB. Western Digital shipped 250.1 EB of HDD storage last year, up from 202 EB in 2013.

The reason why total capacity shipments are setting records amid declines of unit shipments is simple: the average capacities of hard drives have been almost skyrocketing in the recent quarters. Average HDD capacity was around 1 TB in Q3 2014, but it jump by 31% (Seagate) or even 38% (Western Digital) to roughly 1.3 – 1.4 TB per drive in Q4 2015.

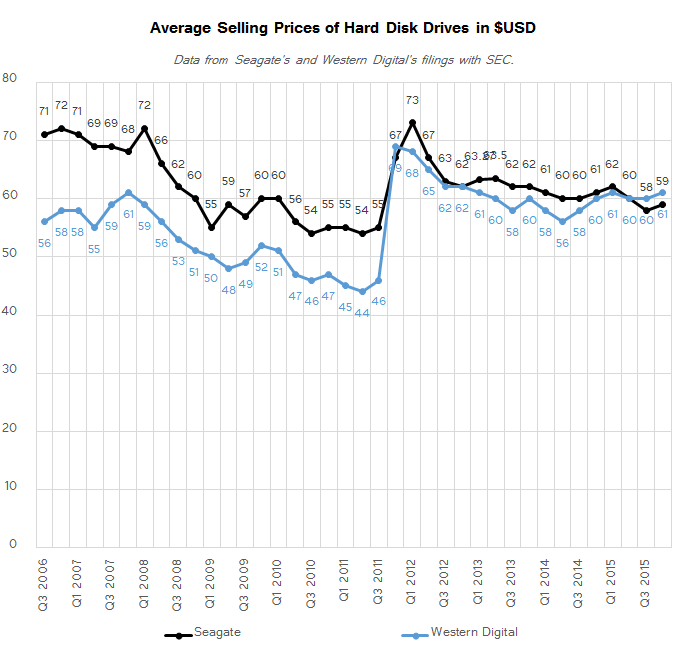

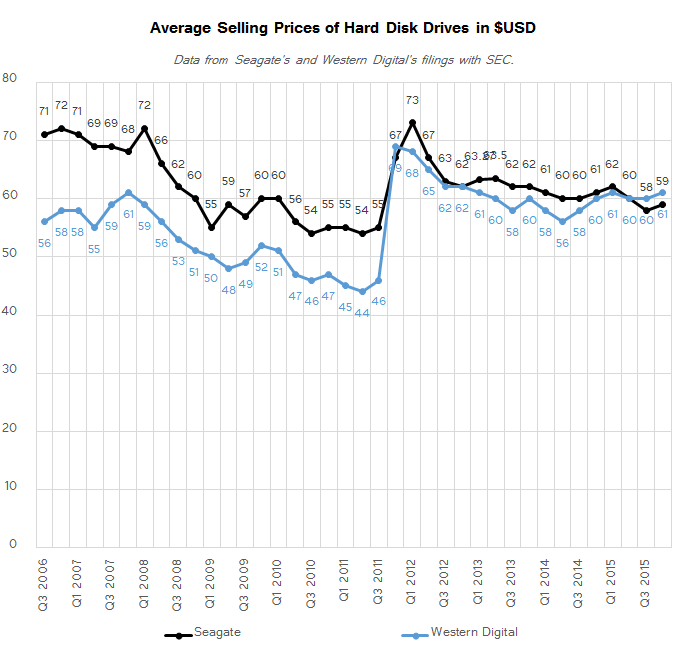

Average HDD Costs Around $60

Yet despite the significant shifts in both units shipped and capacity shipped, HDD average selling prices have hardly changed. The ASP of one HDD is around $60 for both Seagate and Western Digital. HDDs have been on this level for quite some time now.

Historically, Seagate’s ASPs were higher compared to ASPs of its arch-rival because the company sold more enterprise-class HDDs. After the flooding in Thailand in 2011 and Western Digital’s acquisition of Hitachi GST in 2012, its ASPs improved significantly. Perhaps, after the two HDD makers adjust their manufacturing capacities in the coming months and reconsider their prices, their ASPs will improve.

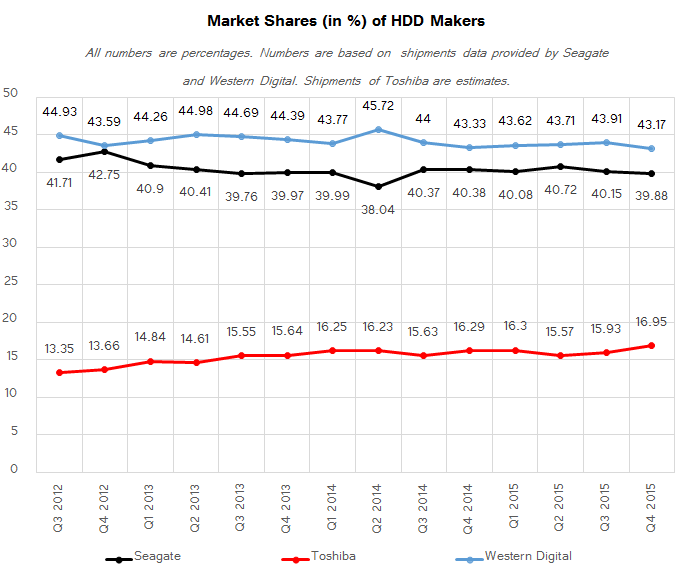

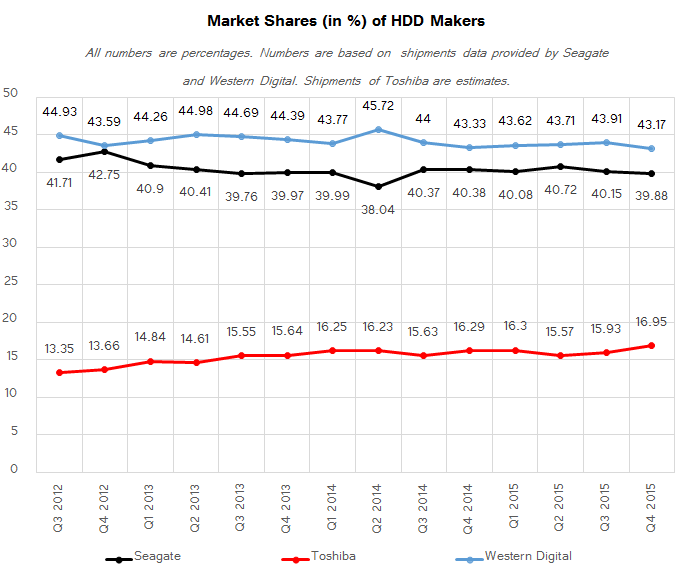

Western Digital Retains Leadership Position

Western Digital controlled about 43% of the HDD market in Q4 2015, based on our estimates. Seagate came second with nearly 40% market share, and finally Toshiba was the distant third with roughly 17%.

Keeping in mind global economic trends, competition from SSDs, and many other factors, it is unlikely that there will be significant changes in the HDD market in the upcoming quarters. In a bid to win market share, manufacturers of hard drives would have to sacrifice already thin margins, something they are unlikely to do. Therefore, the ranking of HDD makers has all chances to remain the same in the coming quarters.

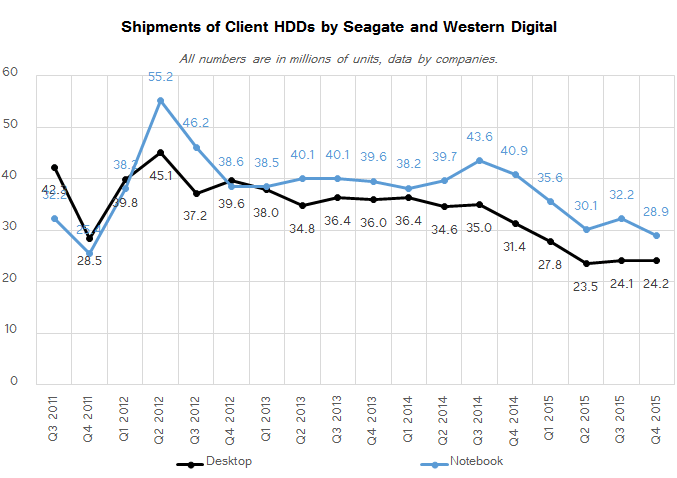

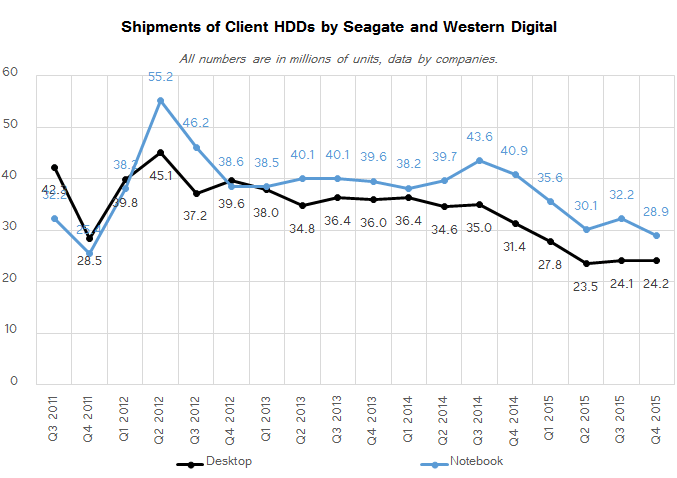

Shipments of Client HDDs Decline

Given the fact that sales of PCs dropped to 71.9 million units, or by around 10.6% year-over-year, in the fourth quarter of 2015, it is not surprising that shipments of client HDDs by the two leading manufacturers declined to approximately 53 million in the same period, or by 26.5%. Even though we should not forget about consumer hard drives by Toshiba, it is essentially a given that SSDs are gaining in popularity in notebooks and high-end gaming systems at the expense of HDDs. According to TrendForce, as much as 25% of laptops used SSDs in Q4 2015.

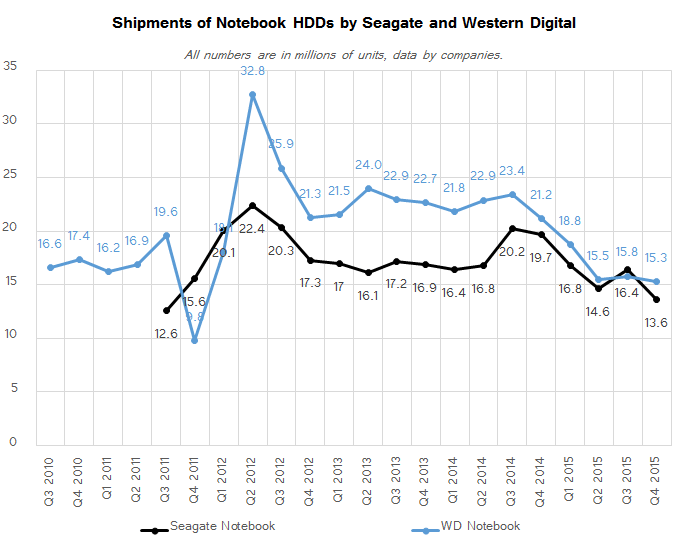

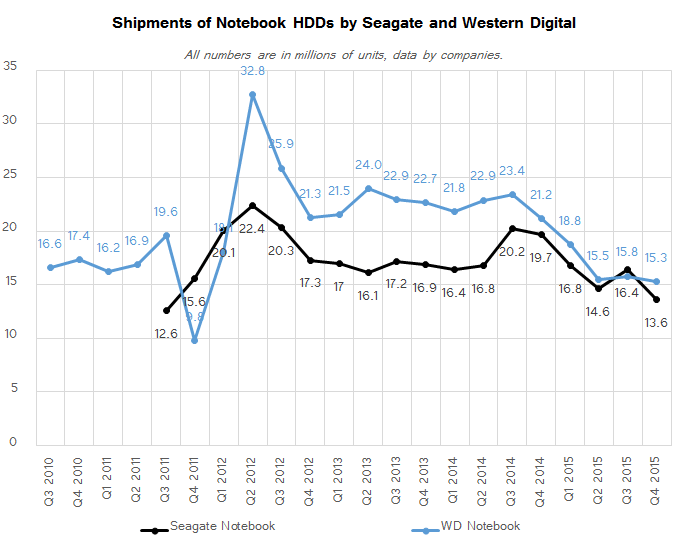

Looking at client notebook (2.5″) HDD sales, we have a somewhat fuzzy picture. Seagate includes shipments hard disk drives it ships for game consoles into its 2.5” client HDD category, whereas Western Digital includes its drives for consoles into its consumer electronics category. Nonetheless, it is evident from the numbers that Western Digital generally sells more 2.5” hard drives than its rival does. In Q4 2015 Western Digital sold 15.3 million 2.5” HDDs (a 28% drop from the same period a year before), whereas Seagate supplied about 13.6 million 2.5” drives to its customers (a 31% decline from the same quarter in 2014).

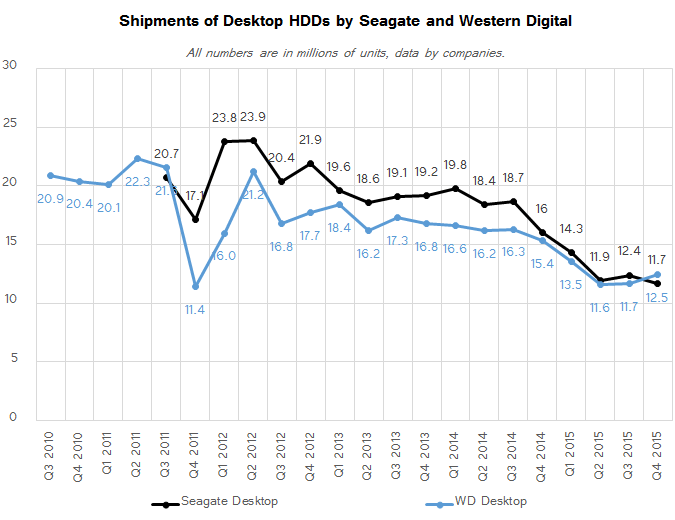

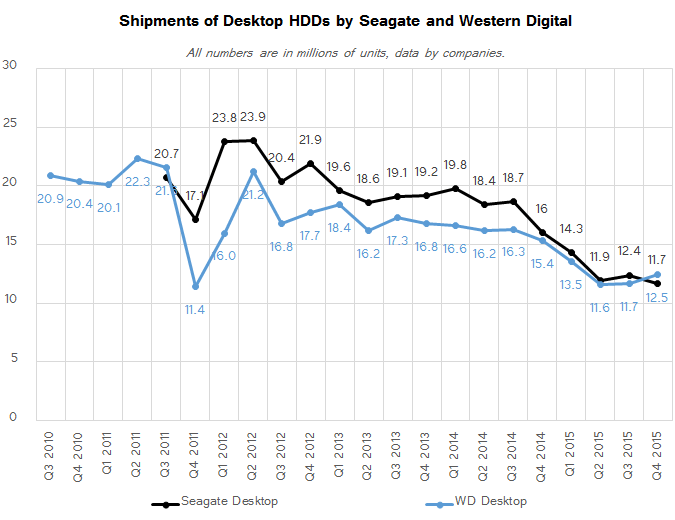

While historically Seagate outsold Western Digital on the desktop HDD market, in Q4 2015 the latter managed to become the world’s largest supplier of 3.5” hard drives with 12.458 million desktop HDDs shipped (versus Seagate’s 11.7 million). Only time will tell whether it will stay on top for long, but considering weak demand for PCs as well as measures to maintain profitability, it remains to be seen whether Seagate, Toshiba and Western Digital will fiercely compete for desktop market share at all.

Seagate claims that its retail, gaming and client offerings are continuing to move to higher capacity points thanks to the company’s latest platters. Perhaps, instead of dropping prices on mainstream capacities, Seagate will attempt to either make higher-end HDDs more attractive, or introduce unique products, such as the recently launched 2 TB 2.5”/7mm SMR HDD for mobile PCs.

Looking at the data, it seems that shipments of 3.5” HDDs have hit the bottom and will hardly drop significantly further going forward. However, taking global economic situation into account, making predictions is barely a good business these days.

Apart from weak sales of PCs and growing adoption of SSDs, there are other reasons why the market of HDDs is shrinking. Desktops may not be the most popular type of computers, but small form-factor systems and all-in-one (AIO) PCs are gaining traction. As a result, instead of purchasing several moderate-capacity HDDs, consumers are buying one large-capacity hard drive for storage purposes. Moreover, since SFF and AIO PCs are not upgradeable, this further reduces addressable market for internal HDDs.

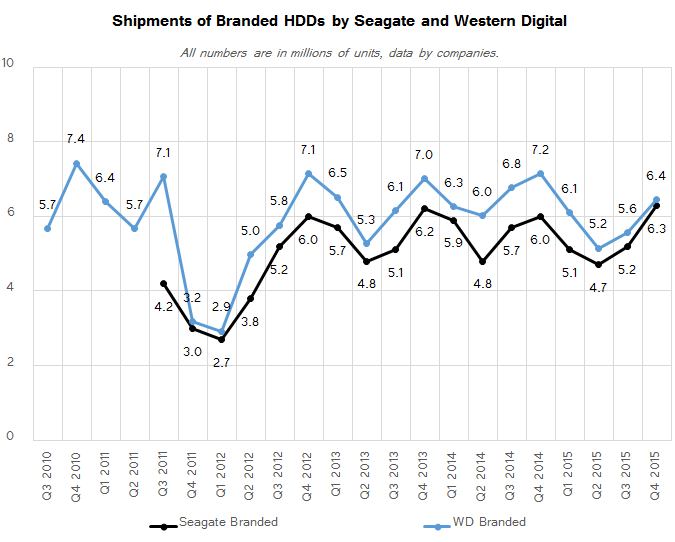

Sales of External HDDs and NAS Remain Strong

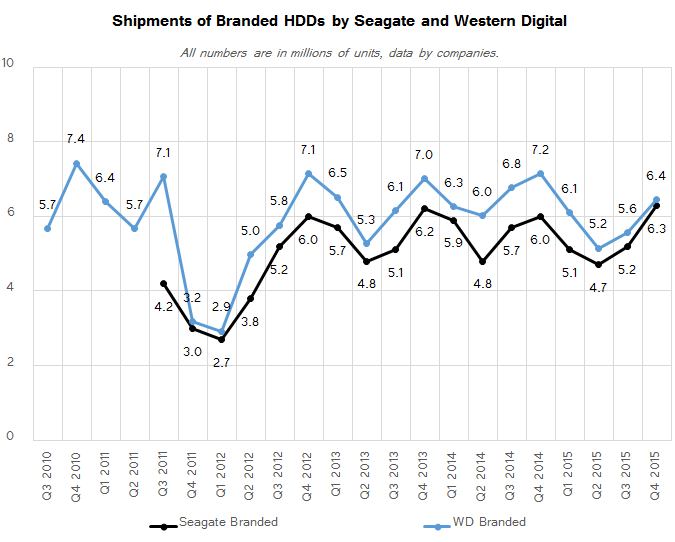

Since the vast majority of notebooks, AIO PCs and SFF systems cannot house more than one hard drive, external storage is getting more popular. Both Seagate and Western Digital sell external HDDs and NAS devices under their own brands as well as under G-Technology and LaCie trademarks.

Sales of external HDDs and NAS from Seagate and Western Digital decreased in 2015 (just like shipments of other hard drives), but at a much slower pace than shipments of internal HDDs.

Western Digital has historically outsold its arch-rival with its My Cloud and My Passport products, but in the recent quarters Seagate began to catch up. In Q4 2015, the two competitors shipped similar amounts of branded storage devices — 6.443 million (Western Digital) and 6.3 million (Seagate) units.

The Q4 2015 was a mixed bag for these two companies. While both managed to increase shipments of their branded hard drives sequentially, sales of Seagate’s products increased by 5% year-over-year, whereas sales of Western Digital’s external storage systems declined by 12% compared to the same quarter a year before.

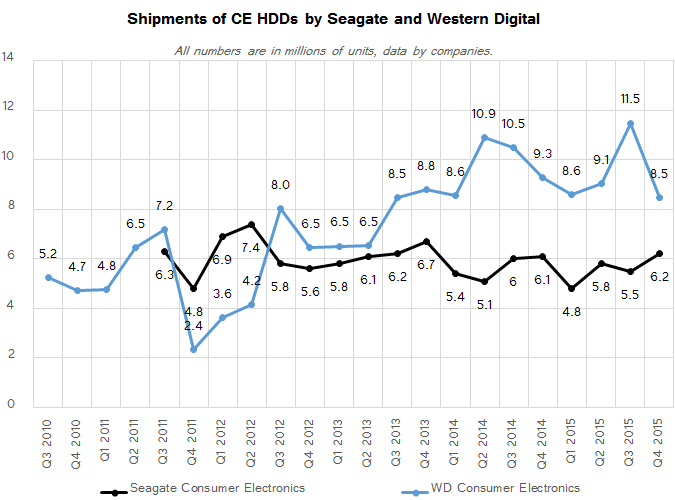

Consumer Electronics Remains a Sizeable Market for HDDs

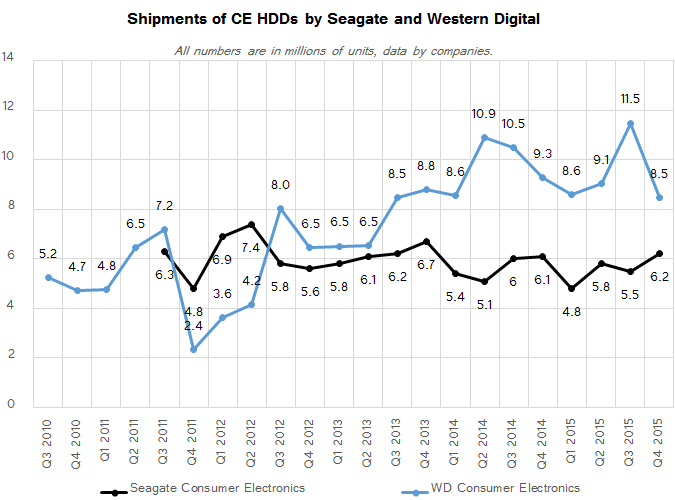

Nowadays the vast majority of consumer electronics (CE) applications use NAND flash memory. There are no ultra-mobile (players, tablets, etc.) devices with rotating media inside, whereas devices like smart TVs tend to utilize NAND memory as well. Applications like set-top-boxes, DVRs, surveillance systems and other may not be significant consumers of HDDs, but their sales are still important overall. Moreover, thanks to success of Sony’s PlayStation 4, Western Digital sells loads of drives for consumer electronics (CE).

In Q3 2015, sales of Western Digital’s CE HDDs set a record as the company shipped millions of HGST Travelstar hard drives for the PS4. In the fourth quarter sales of Western Digital’s CE drives dropped to 8.46 million, a 9% drop year-over-year. Seagate includes sales of its drives for consoles into its client HDD shipments, so, it is impossible to directly compare CE HDD businesses of the two hard drives makers.

Seagate recently said that shipments of its HDDs for surveillance applications were growing rapidly and there was strong demand for HDDs specifically designed for these workloads. Hard drives for surveillance and video streaming systems should offer low price per gigabyte, support for ATA streaming technology and improved reliability. Thanks to its latest platters with high areal density, Seagate can address this market with unique offerings. Western Digital also addresses these markets with its Purple HDDs, which use its advanced platters as well.

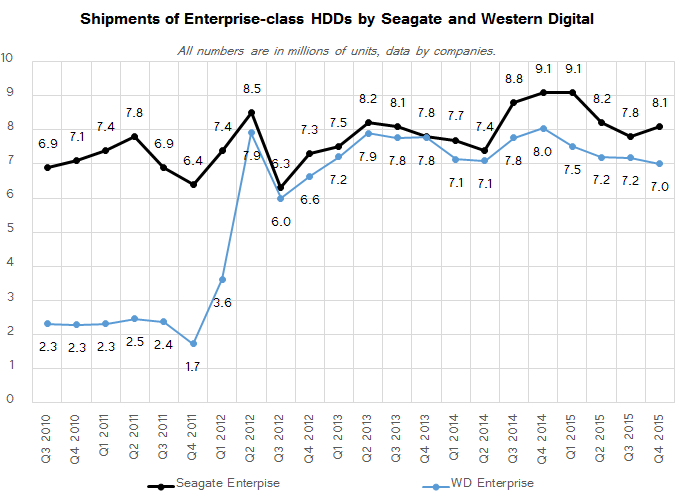

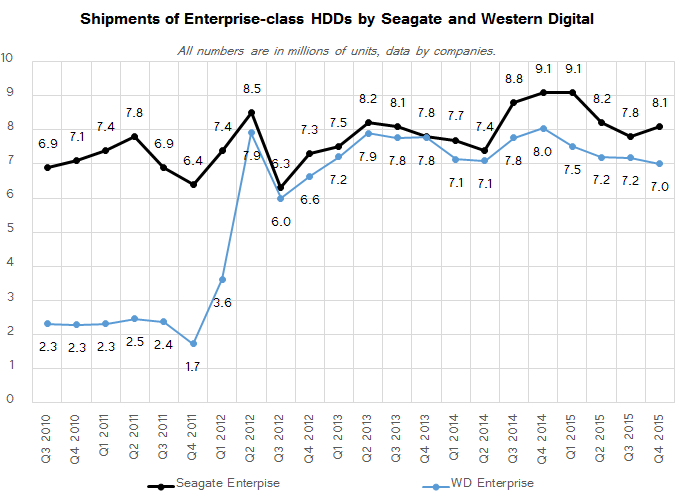

Sales of Enterprise HDDs Remain High

Enterprise-class hard drives are arguably the most lucrative part of HDD makers’ business. Such drives are naturally not shipped in huge quantities, but they are sold with a huge premium because they are based on specially-designed platforms. High-performance HDDs for mission-critical applications can feature 10000 RPM spindle speeds and the faster SAS interface. Despite their moderate capacities, such hard drives retail for $700+ and are still used by many datacenters even with the rise of SSDs. Moreover, both Seagate and Western Digital now offer helium-filled HDDs for those, who need maximum capacity per rack and are willing to pay extra for that.

Seagate has been the leader of the enterprise HDD market in terms of unit sales for a long time and nothing changed last year. The company sold 33.2 million enterprise-class hard drives in calendar 2015, up 200 thousand from the previous year. The reason why the company failed to significantly increase unit sales of its server HDDs was slower demand for its 4 TB and 6 TB nearline HDDs in the second half of 2015. Even with this, the average capacity of its enterprise drives increased to 2.2 TB in Q4 2015, or by 15% year-over-year, the company said recently. Enterprise total capacity shipped was up 21% sequentially in the fourth quarter, according to Seagate, which indicates that the product mix improved in Q4 after the manufacturer introduced its family of 8 TB PMR-based HDDs in September. Right now Seagate is shipping such hard drives in high volume.

Although HGST’s product portfolio has included high-capacity 8 TB helium-filled HDDs for well over a year, the vast majority of the company’s clients are still evaluating its helium drives, which is why Western Digital did not capitalize on its leading capacities from the unit sales point-of-view. The company sold 28.911 million server-grade hard drives in calendar 2015, down from 30 million in 2014 and 30.6 million in 2013.

In Q4 2015, sales of Western Digital’s enterprise HDDs dropped to 7.008 million units, or by 12.5% compared to the same period a year before. Nonetheless, the growing number of datacenters are deploying its helium-filled 8 TB and 10 TB drives these days, so, the company remains optimistic about its future in the enterprise. HGST sold 1.5 million helium-filled HDDs last quarter, up from a million a quarter before. Moreover, despite of unit sales drop, Western Digital saw 32% year-over-year growth in enterprise capacity shipments in Q4 2015.

Final Words

The market of personal computers is transforming and so is the data storage market. As more client PCs adopt SSDs, fewer internal consumer-class HDDs will be sold. That said, even with these declines the overall market for hard drives is not going anywhere.

Looking at broader market trends, as Ultrabooks and other thin form-factor notebooks gain in popularity, unit sales of 2.5” HDDs will inevitably suffer. Nonetheless, analysts from TrendForce expect 66% of laptops to use hard drives this year, hence, TAM of 2.5” HDDs will still exceed 100 million units in 2016, especially thanks to the latest game consoles from Microsoft and Sony. What remains to be seen is how HDD makers optimize their mobile lineups to improve profitability (by cutting-down costs) while making their products attractive from capacity, performance and price standpoints. Solid-state hybrid drives have not become popular or widespread so far. Similarly, the recently introduced SMR-based 2.5”/7 mm HDD with 2 TB capacity looks more like an experiment than a product Seagate pins a lot of hopes on. So, it should be interesting to see what Seagate, Toshiba and Western Digital plan to do in order to sustain relevancy of 2.5” HDDs for mainstream PCs in the coming years.

Shipments of 3.5” HDDs for client computers have also been decreasing for a while, but last year the industry still sold well over 100 million of such hard drives. The form-factor has a lot of advantages: it is inexpensive, it can offer high capacity points and it is compatible with 100% of desktop motherboards that are available today. Nonetheless, since unit sales of 3.5” HDDs are declining, expect manufacturers to shrink the number of their offerings going forward. Last year Western Digital already folded its WD Green drives into its WD Blue family. In the future, makers of HDDs may get rid of mid-tier affordable 7200 RPM HDD families and focus on cheap 5400 RPM drives and high-performance 7200 RPM drives in a bid to optimize their costs.

Meanwhile both Seagate and Western Digital claim that while the HDD TAM is declining because of shrinking sales of consumer drives, shipments of enterprise-grade HDDs are growing. However, if we take a closer look at the numbers posted by these two companies in 2012 – 2015, we will notice that Seagate sold between 31.6 and 33.2 million server HDDs per year, whereas shipments of enterprise hard drives from Western Digital fluctuated around 30 million units per annum during the period.

Since average capacities of server-grade HDDs are rapidly increasing, it is likely that many enterprises are adopting new 3.5” hard drives, whereas sales of mission-critical 2.5”/3.5” models are either stagnating or even declining as SSDs take their place in the datacenter. Keeping in mind that it is easier to swap HDDs than to expand the datacenter itself in order to increase storage capacity, it is logical to assume that unit sales of server-grade hard drives will remain at the current level, or will even grow slowly. The bigger question is whether shipments of such HDDs will actually start to grow rapidly to compensate for diminishing sales of consumer drives. This did not happen in the recent years and it is unclear whether this will happen in 2016.

Methodology and Important Notices

There are three major manufacturers of hard drives today: Seagate, Toshiba and Western Digital. Other suppliers are reselling hard drives made by these three companies.

Seagate and Western Digital reveal their HDD unit shipments as well as TAM (total available market) estimates every fiscal quarter. While such numbers are considered preliminary, they are usually rather accurate and re-affirmed by third-party analysts. Our TAM is the midpoint between Seagate’s and Western Digital’s TAM estimates. If only one hard drive maker reveals its TAM, we consider the number from only one vendor.

Meanwhile Toshiba does not officially disclose its HDD shipments. We subtract quarterly shipments of Seagate and Western Digital from our TAM estimate to get the number of drives sold by Toshiba. The approach is is the reason why we do not report historical shipments of Toshiba prior to Q3 2012. Based on estimates of hard drive makers and industry observers, Toshiba cannot produce more than 22 – 23 million of HDDs per quarter.

Seagate’s and Western Digital’s fiscal quarters end on the last business day of the last week of a calendar quarter (e.g., the Friday next to December 31). While fiscal quarters of HDD makers may not correspond exactly to calendar quarters, they are very close. Fiscal years of Seagate and Western Digital do not correspond to calendar years as they begin in July.

Historical TAM data comes from financial reports of Seagate and Western Digital.

Note 1: Seagate completed acquisition of Samsung’s HDD business in December, 2011. The company started to include sales of Samsung-branded HDDs in its quarterly shipments in Q1 2012 (Q3 FY2012).

Note 2: Western Digital closed acquisition of Hitachi Global Storage Technologies in March, 2012. Western Digital began to include HGST shipments in its financial reports in Q2 2012 (Q4 FY2012).

Note 3: Toshiba acquired some of Western Digital’s 3.5-inch HDD manufacturing equipment and intellectual property in May, 2012. It was expected that the manufacturing transfer could be complete within 6 to 12 months. Western Digital made HDDs for Toshiba on a contract basis until late Q4 2012. Due to the contract manufacturing agreement between Western Digital and Toshiba in 2012, there may be some inaccuracies in the historical data in that period (i.e., since the drives were made by Western Digital and then sold to Toshiba, they are attributed to the former, not the latter).

Note 4: Seagate defines client HDDs as 2.5” and 3.5” hard drives for desktops, notebooks and hybrid PCs as well as game consoles. Seagate considers HDDs for external storage and network-attached storage (NAS) as “branded” drives. Hard disks for DVRs and surveillance systems belong to Seagate’s family of HDDs for consumer electronics. Enterprise lineup includes 2.5” and 3.5” drives for mission critical (SAS, SCSI, Fibre Channel), enterprise storage, nearline and other datacenter applications.

Note 5: Western Digital attributes desktop and mobile 2.5” and 3.5” hard drives to client HDDs. External hard drives and NAS are referred to as “branded products”. Western Digital’s consumer electronics HDDs are used in DVRs, game consoles, video streaming applications and security video recording systems.