AMD Ryzen Threadripper 1950X and 1920X: We’re Allowed To Show Pictures Now

One of the interesting things to come out of this Threadripper launch is the stack of embargos. Last week AMD revealed the launch date and pricing, which will incidentally also be the date for our review of both chips. AMD also inserted a small embargo in the middle for today, allowing media outlets to do unboxings.

We’re Allowed To Show Pictures Now

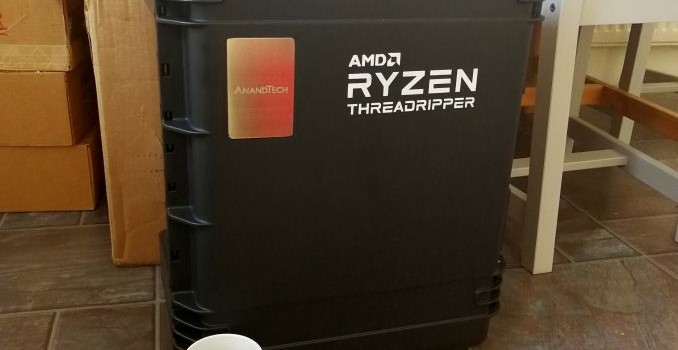

Rather than discuss each element of what AMD shipped the ~250 reviewers who have review kits, this article is going to be mainly a picture story with annotations. Starting with a pelican case that AMD shipped the CPUs in.

Inside the massive padded box were two CPUs in special cases, along with a paperweight.

Yes, that’s an actual CPU in the paperweight, printed with AnandTech’s logo. We got CPU 30 out of 250.

Who has #1 ?

Each of the CPUs was in this overly padded secondary box.

The instructions were far from clear. I tried to record this on video. Some swearing was involved – you definitely need two hands for this.

The CPU is housed in its own secondary support system. Twist, unlock, pull, grip, fail, try again, use force, swear, then eventually get the latch off.

The CPU comes in this orange holder. The orange holder goes into the motherboard as well, so there’s no need to take the CPU out.

The box also contains a bracket for Asetek liquid coolers to fit, and a Torx Screwdriver. There are some stickers as well.

Putting it in the socket is fairly easy – three Torx screws and the mechanism pops open. Slide into the tray, close the screws. I had more issues with the CPU cooler mechanism than the CPU tray.

This last picture shows how thermal paste spreads across the CPU after a couple of days of testing with a tight liquid cooler. We can’t say much about temperatures at this point because of the embargo.

Paperweight. No idea if the CPU inside actually works.

Along with the CPUs, AMD supplied almost everything needed for the system: an ASUS X399 Zenith Extreme motherboard, 32GB of G.Skill Trident RGB DDR4-3200 C14 memory, a 512GB Samsung 960 Pro M.2 drive, a Thermaltake Toughpower Grand 1200W, and a Thermaltake Floe Riing 360 Premium liquid cooler (a 3×120 side radiator). The only thing missing was a Vega GPU (ed: you don’t get everything).

What Does This Mean

I’ve never had a review sample come with quite so much kit in such extravagant packaging. Back with Ryzen they supplied a hardwood box with all the kit, and this one goes another stage up. AMD knows they can cause a stir on the social channels by being big and bright rather than staying understated, and to a certain extent, it works (as long as the company can afford it). It’s a corner of the product release cycle that AMD has honed in on, or one that its competitors have missed, although it is hard to gauge the return on investment and requires a marketing head to approve it nonetheless.

| AMD Ryzen SKUs | |||||||||

| Cores/ Threads |

Base/ Turbo |

XFR | L3 | DRAM 1DPC |

PCIe | TDP | Cost | Cooler | |

| TR 1950X | 16/32 | 3.4/4.0 | ? | 32 MB | 4×2666 | 60 | 180W | $999 | – |

| TR 1920X | 12/24 | 3.5/4.0 | ? | 32 MB | 4×2666 | 60 | 180W | $799 | – |

| TR 1900X | 8/16 | 3.8/4.0 | +200 | ? | 4-Ch | 60 | ? | $549 | – |

| Ryzen 7 1800X | 8/16 | 3.6/4.0 | +100 | 16 MB | 2×2666 | 16 | 95 W | $499 | – |

| Ryzen 7 1700X | 8/16 | 3.4/3.8 | +100 | 16 MB | 2×2666 | 16 | 95 W | $399 | – |

| Ryzen 7 1700 | 8/16 | 3.0/3.7 | +50 | 16 MB | 2×2666 | 16 | 65 W | $329 | Spire |

| Ryzen 5 1600X | 6/12 | 3.6/4.0 | +100 | 16 MB | 2×2666 | 16 | 95 W | $249 | – |

| Ryzen 5 1600 | 6/12 | 3.2/3.6 | +100 | 16 MB | 2×2666 | 16 | 65 W | $219 | Spire |

| Ryzen 5 1500X | 4/8 | 3.5/3.7 | +200 | 16 MB | 2×2666 | 16 | 65 W | $189 | Spire |

| Ryzen 5 1400 | 4/8 | 3.2/3.4 | +50 | 8 MB | 2×2666 | 16 | 65 W | $169 | Stealth |

| Ryzen 3 1300X | 4/4 | 3.5/3.7 | +200 | 8 MB | 2×2666 | 16 | 65 W | $129 | Stealth |

| Ryzen 3 1200 | 4/4 | 3.1/3.4 | +50 | 8 MB | 2×2666 | 16 | 65 W | $109 | Stealth |

What now? Time to get back to testing. Review next week.

The Change in NDA Philosophy: A Personal Commentary

This new ‘unboxing’ sort of embargo has been borne from a rapid change in how media approaches launches and NDAs.

In the past, from 2014 and before, when there was a product NDA in place it was expected that no media would even acknowledge that they had the product, let alone disclose the date of launch. In the advent of a more social media focused – and younger – technology press, skirting those NDA lines with product images has now become almost a standard: if you have the product, flaunt it, and generate hype for the review/video. Even when there is an NDA in place specifically barring certain types of content, such as unboxings, it seems that posting screenshots or gifs of the upcoming unboxing content being edited before the NDA is becoming the norm.

The reasoning stems from the fact that NDAs typically restrict product reviews and only mention performance and data analysis to be revealed at a certain date, and the argument is that the NDAs often say nothing about showcasing the product before the launch (or even if the NDA is itself under NDA). Depending on the company, this has had a mixed response: typically an incumbent market leader will come down hard if NDA rules are pushed, although PR teams and underdogs like to push the hype train as many times around the track as possible if the product is good.

AnandTech in this respect is fairly old-school: we’d rather spend more time testing the product to give more data for our analysis and reviews, making sure our readers have the sufficient knowledge at hand to invest in a product. Unboxings on AT are few and far between because there usually isn’t that much to show for our typical user base that know technology – it only really makes sense to us when something is unusual (like Threadripper), or to show to new users that may become enthusiasts. Ultimately, it’s that latter group that has spurned the tech media to invest in social media for this sort of content, especially around high-performance components or hardware where it actually makes sense, like monitors. Unboxing products like a CPU would usually take several seconds: CPU, manual, cooler, sticker, done.

Related Reading

- The AMD Zen and Ryzen 7 Review: A Deep Dive on 1800X, 1700X and 1700

- The AMD Ryzen 5 1600X vs Core i5 Review: Twelve Threads vs Four at $250

- The AMD Ryzen 3 1300X and Ryzen 3 1200 CPU Review: Zen on a Budget

- AMD Launches Ryzen PRO CPUs: Enhanced Security, Longer Warranty

- How To Get Ryzen Working on Windows 7 x64

- AMD Launches Ryzen: 52% More IPC, Eight Cores for Under $330