AMD Financial Analyst Day 2015 Round-Up

Having just wrapped up a bit ago is AMD’s 2015 Financial Analyst Day (FAD). For AMD FADs are a combination of roadmap updates and number breakdowns for financial analysts and investors, showcasing where the company intends to go and why investors should continue to back the company.

We’ve been covering FAD 2015 throughout the afternoon, and we have seen AMD make a number of announcements and roadmap reveals throughout the event. The individual announcements are below, and meanwhile now that the event has wrapped up we want to provide a quick summary of what AMD is going to be up to over the next two years.

AMD Charts Future Growth Opportunities

AMD’s 2016-2017 x86 Roadmap: Zen Is In, Skybridge Is Out

AMD’s K12 ARM CPU Now In 2017

AMD’s 2016 GPU Roadmap: FinFET & High Bandwidth Memory

AMD To Launch New Desktop GPU This Quarter (Q2’15) With HBM

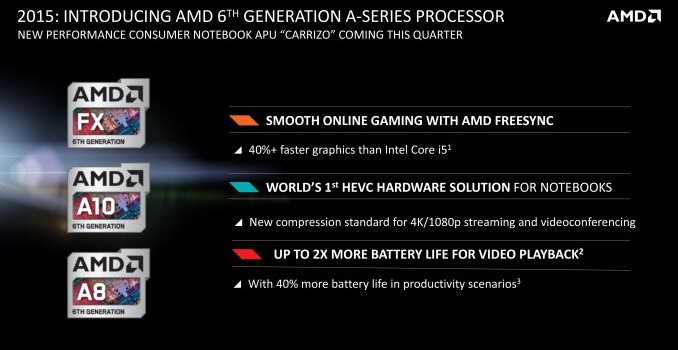

AMD Announces 6th Generation A-Series APU Branding – Carrizo Due This Quarter

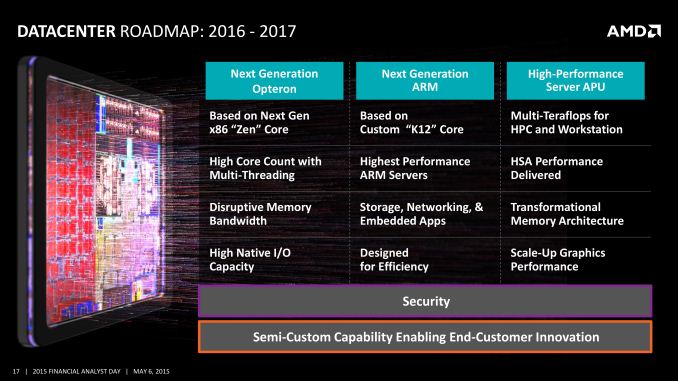

AMD’s 2016-2017 Datacenter Roadmap: x86, ARM, and GPGPU

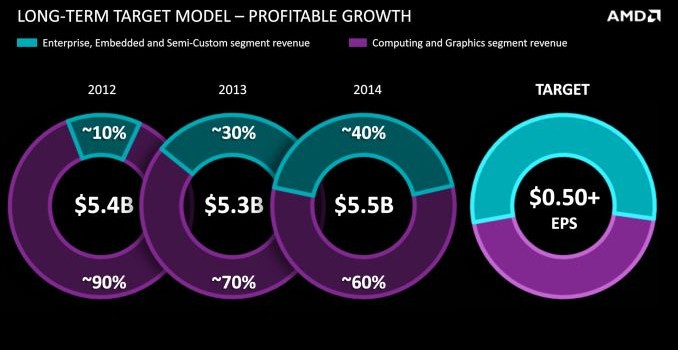

With AMD’s FAD 2012 being a major event for the company – one where then-CEO Rory Reed announced AMD’s intention to move away from being almost solely PC focused to a mix of PC, semi-custom, and ARM products – FAD 2015 by comparison is a far more tame event. Under the direction of Dr. Lisa Su, AMD is largely executing on the plan they set into motion some time ago. And where they have made changes, such as dropping SeaMicro, AMD has announced those changes in advance. So this year’s FAD does not see AMD announcing major changes to the company’s direction.

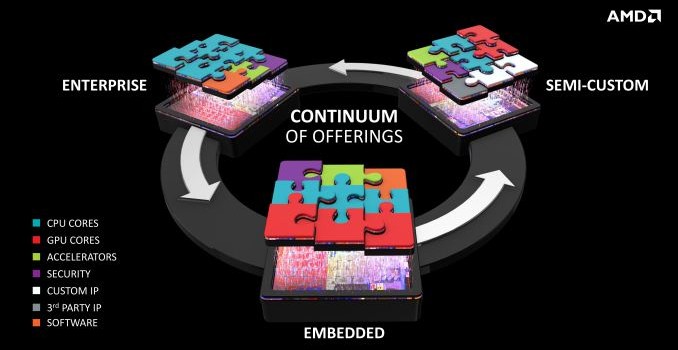

So what is AMD’s direction over the next two years? The short answer to that is that the company is focusing on what they believe to be higher margin, higher growth opportunity markets where they can take a chunk of those markets without necessarily having to wrest revenue and sales from existing competitors. Overall AMD sees their three big growth markets as gaming, immersive platforms, and the datacenter market.

At the same time what AMD is looking to avoid is low-margin markets where they can’t do something to set themselves apart. AMD has made it clear that they’re not going to invest in fields such as mobile (smartphones/tablets) or IoT client devices, as while that’s a high growth field, it’s already overweight with competitors who either have the cost control (MediaTek) or the war chest (Intel) to drive margins down to levels AMD cannot sustain. Similarly, AMD is working to reduce their presence in the low-end PC market, as that too suffers from low margins, and is coupled with a poor outlook that has seen AMD get burnt by a significant drop in demand (and consequently revenue) in that market.

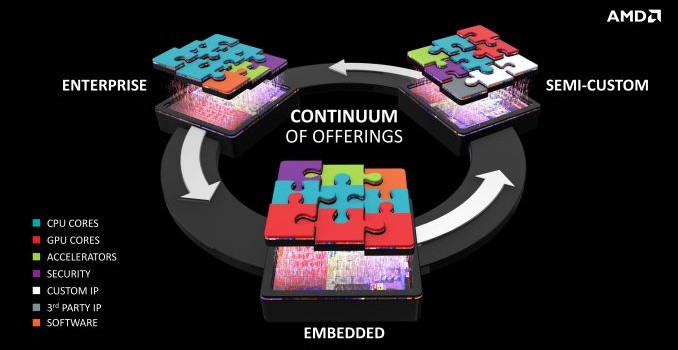

The one exception to this of course is semi-custom silicon, which although is not high-margin, allows AMD to leverage their strengths. Nowhere else can you find a vendor with a top-tier GPU profile, custom x86 CPUs, custom ARM CPUs, and the willingness to help customers build customized chips around those building blocks. Semi-custom silicon also presents AMD with some relatively stable revenue, as contracts for semi-custom designs will typically involve supplying chips for a number of years.

To achieve their goals, AMD has set out a roadmap through 2016 and 2017 to develop the technologies necessary to compete in their respective markets, and to deliver the performance necessary for both semi-custom silicon and finished AMD products.

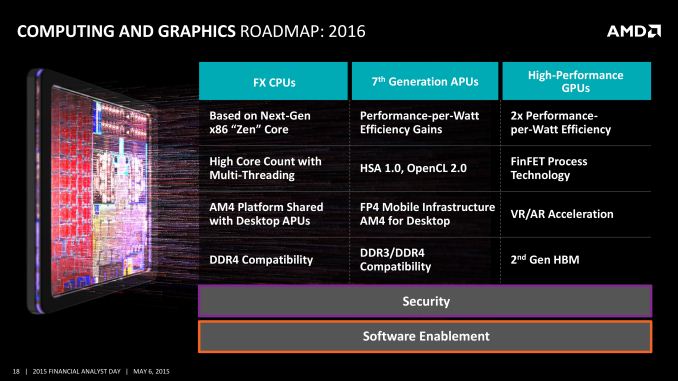

The big item on AMD’s agenda is of course Zen, the company’s forthcoming x86 CPU design. Scheduled to launch in 2016, starting with the high-performance desktop, Zen is a return to fundamentals of sorts for AMD. We do not have performance estimates for Zen, but from an architectural standpoint AMD is making it clear that they are shooting for much higher IPC with Zen than Carrizo/Excavator, touting a 40% increase in IPC.

Zen will ultimately be driving AMD’s entire range of x86 products, top to bottom, datacenter to laptop. AMD’s Dozer and Cat families are at an end, and in the end there will be only Zen. Zen in turn will be part of a long-term process for AMD; the company already has newer iterations of Zen in the works (Zen+) which further improve on the architecture farther out. Coupled with significant gains AMD is expecting to enjoy from FinFET processes, and the company is putting on their optimistic face for their chances in the x86 market.

In fact AMD is backing Zen to the point where other projects have been pushed to the wayside or canceled altogether. AMD’s project Skybridge – a plan for 20nm ambidextrous x86 and ARM CPUs – has essentially been canceled as a result of the combination of lack of customer need for ambidextrous CPUs and the generally poor performance of the 20nm process. Meanwhile Zen’s ARM sibling – K12 – has been pushed back from 2016 to 2017 to allow AMD to complete Zen first, and then roll what they’ve learned from Zen into K12.

For AMD this marks a return to form, and a very aggressive move on the x86 market. After having seen their datacenter market share fall to just 1.5%, for example – with the company admitting they did not invest in high-performance CPUs and it cost them most of their market share – AMD is optimistic that they can recover their datacenter market share through the combination of Zen, K12, and their GPGPU capabilities. This in turn means hitting the datacenter in both the CPU and HPC markets, and even going one step beyond with a forthcoming, very high performance HPC APU that combines all of AMD’s strengths.

Meanwhile on the GPU front, AMD is not providing quite as much visibility on their GPU roadmap, but they are sharing their plans out to 2016. Launching this quarter will be a new AMD desktop product featuring High Bandwidth Memory (HBM), the first such product in the GPU space. HBM promises to significantly increase AMD’s available memory bandwidth and allow their partners to work on more innovative card designs due to the smaller amount of space an HBM solution requires.

2016 in turn will see AMD continue their focus on HBM with the release of products using HBM Gen2, all the while releasing their first GPUs manufactured on a FinFET process. AMD isn’t naming which process they’re using, though either way it would be a significant step up in manufacturing from the current 28nm process their GPUs use. Overall AMD is touting a 2x increase in perf-per-watt for their 2016 GPUs, with most of that gain coming from the shift to FinFET.

Longer term, while AMD is not committing towards any specific products, AMD is strongly hinting at HBM coming to APUs as well. AMD’s APUs have traditionally struggled under the limited amount of bandwidth 128-bit DDR3 provides, so an HBM-enabled APU would help to further improve AMD’s GPU performance on their APUs.

Wrapping things up, the key to AMD’s plans for the next two years will hinge on both properly anticipating the market and in executing on technology. AMD will need to correctly predict opportunities to grow – particularly rapidly expanding markets as opposed to stealing revenue from existing players – and then execute on that in a timely manner with solid hardware across both the CPU and GPU space. AMD believes they have the pieces they need in development, and with 2015 almost half-over the company is finally reaching the point where their earlier transition is complete, so it will be interesting to see how AMD’s next two years unfold. The company is not yet in dire straits, but after losing market share and seeing gross margins suffer, now is the time where AMD needs to reverse their fortunes and reach profitability if they’re to ensure their own future.