Computex 2016: Intel Keynote Live Blog at 2pm TPE (2am EDT)

We’re at Intel’s Computex Keynote here at Computex, which is being headlined by Intel’s Diane Bryant.

We’re at Intel’s Computex Keynote here at Computex, which is being headlined by Intel’s Diane Bryant.

Nine months. This is how long it has taken the retail price of Intel’s Core i7-6700K processor to drop to the level recommended by Intel. Despite slow sales of PCs in general, it would seem that demand for Intel’s latest Skylake processors has so far been rather strong, or the chipmaker could not meet demand for many SKUs months after they were introduced. Right now, virtually all major stores in the U.S. sell Intel’s latest unlocked chips at their MSRPs. Meanwhile, Intel’s Core i7-5820K chip, which used to be cheaper than the Core i7-6700K for months, recently got more expensive.

Intel officially announced its most advanced quad-core desktop processor for mainstream enthusiasts, the Core i7-6700K (four cores with Hyper-Threading, 4.0 GHz/4.2 GHz, 8 MB cache, Intel HD Graphics 530 core, unlocked multiplier) in early August 2015. You can read our review here. The chip, which is positioned below the high-end desktop (HEDT) platforms, has always had an suggested retail price of $350. However, since we have been tracking the price in these short pieces, the 6700K has not only been above $350, but it was actually more expensive than the Core i7-5820K, the entry-level HEDT part from Intel. The price of the Core i7-6700K peaked in December at $420-440, then dropped slightly to $412 in February and only in April it hit $350, about eight-to-nine months after its introduction.

According to CamelCamelCamel, a price-tracker that monitors Amazon and its partners, the Core i7-6700K has been available for around $350 for several weeks now. At press time, the retailer charged $349.69 for the processor. At the same time, PriceZombie, which monitors Newegg, reveals that Newegg dropped the price of Intel’s most advanced unlocked quad-core CPU for desktops to $349.99 in late April.

The Intel Core i7-6700K (BX80662I76700K) is currently available for around $350 or so from all major retailers in the U.S., including Amazon, B&H Photo, NCIXUS and Newegg, according to NowInStock. BestBuy lists the CPU for $409.99, but does not have it in stock at the time to press. While I have no idea if Intel is now shipping more Core i7-6700K processors than it did several months ago, it is evident that supply of the part now meets demand and retailers are no longer charging a premium for it, (at least, in the U.S).

The popularity of the Intel Core i5-6600K (four cores, 3.50 GHz/3.90 GHz, 6 MB cache, Intel HD Graphics 530, unlocked multiplier) among enthusiasts is well deserved: in most consumer situations its performance is on par with the Core i7-6700K, which costs around $100 more. Unfortunately, just like its bigger i7 brother, the i5-6600K chip was scarcely available. Due to strong demand, the Core i5-6600K was sold for $290-$330 last year, which is considerably more than its official MSPR of $243.

Right now, the Core i5-6600K (BX80662I56600K) is currently available from all major U.S. retailers for around $245 or just slightly lower. Amazon sells the CPU for $242.48, whereas Newegg charges $244.99.

Based on data from CamelCamelCamel and PriceZombie, the price of the Core i5-6500K has been relatively stable at around $240-$245 for several weeks now. If Intel does not cut supply, or demand for the chips explodes, the price will continue to fluctuate in the same range in the coming months.

The Intel Core i7-5820K (six cores with Hyper-Threading, 3.30GHz/3.60 GHz, 15 MB cache, unlocked multiplier) is based on the previous-generation Haswell-E microarchitecture, but with six cores, a 3.30 GHz default clock-rate, unlocked multiplier and $396 price-point, it was a very interesting product from day one. Moreover, due to strong demand for microprocessors powered by the Skylake microarchitecture, the price of the Core i7-5820K dropped to $380 in February and $349.99 in late March. Unfortunately, good things do not seem to last forever.

Right now, the Core i7-5820K (BX80648I75820K) costs $382.99 at Amazon and $389.99 at Newegg, which means that the chip got around 10% more expensive in under a couple of months. The reasons for the increase are unclear. Perhaps Intel started to gradually reduce shipments of its Haswell-E processors ahead of the Broadwell-E introduction later this year, or maybe demand for the smallest HEDT chip just got higher for some reason.

To use the Core i7-5820K you will need an X99-based motherboard, which on average can cost more than an Intel 100-series-based motherboards for Skylake chips, an advanced cooler to cover the 140 W CPU, and four DDR4 memory modules to maximize the available memory bandwidth. Such motherboards will support Broadwell-E processors and many of them feature modern functionality like USB-C 3.1, M.2, Thunderbolt 3 and so on. Moreover, makers of motherboards are preparing a new wave of their Intel X99-based offerings (for example, ASUS has already announced them) with further refinements. Right now, the new generation of Intel X99-based platforms is not available, but it makes a great sense to wait for such motherboards to arrive and only then buy an LGA2011 v3 processor.

In the meantime, we can only conclude that the HEDT Core i7-5820K chip is back where it should be: above the Core i7-6700K designed for mainstream enthusiasts. Perhaps, the 5820K will get cheaper in the coming weeks again, or something better comes up, but right now the Core i7-6700K is a more affordable CPU.

As our long-time readers are aware, Intel’s 14 nm process technology was a tough nut to crack for the company. Intel had to delay volume production of CPUs using this fabrication process by a year and then start with smaller chips in order to maximize yields and minimize per-unit costs. Due to higher costs and some other reasons, the ramp of 14 nm and Skylake processors took some time, which is one of the reasons why some of the socketed chips were in short supply. Nonetheless, things seem to be getting better.

Intel now uses four fabs to produce its CPUs using 14 nm process technology: D1D, D1C and D1X fabs in Hillsboro, Oregon as well as Fab 24 manufacturing facility in Leixlip, Ireland. Moreover, yields of 14 nm chips are getting better. Back in April, the company said that the Client Computing Group managed to achieve operating profit of $1.9 billion in Q1 FY2016, or 34% more than in the same period a year before, as a result of “lower 14 nm unit costs on notebooks”.

“First quarter gross margin of 62.7% was approximately a point higher than our expectations, driven by lower 14 nm costs,” said Stacy Smith, chief financial officer of Intel, during a conference call with investors and financial analysts.

Besides this, starting late last year Intel has been producing its multi-core Xeon E5 v4 chips using the 14 nm process in volume (and even shipping them for revenue, according to Diane Bryant). Keeping in mind that multi-core chips have large dies, which are harder to produce and which are prone to more defects, production of such dies means that process technology has to be mature enough and yields are under control for suitable sales (although some premium partners will want the first ones off the line regardless of cost). Indirectly, this may mean that Intel can now also produce more unlocked desktop CPUs with high frequency, which is why such products are now widely available and retailers do not charge extra for them.

Despite the fact that PC market is down in absolute volume in general, the market of gaming PC is actually expanding. Intel’s Core i7-6700K and Core i5-6600K processors are primarily used for gaming systems, therefore, demand for such CPUs is strong.

“Our gaming PCs are growing at double-digit rates year-over-year,” said Bryan Krzanich, chief executive officer of Intel.

Mr. Krzanich is not the only one to say that gaming PCs are on the rise and their sales do not suffer as a result of any global economic turmoil or adjustment in how users perceive the devices around them. Jen-Hsun Huang, the head of NVIDIA, recently said that people buy expensive gaming PCs regardless of any economic slowdowns, and NVIDIA’s recent financial announcements, along with the enterprise products based on gaming technology, show this.

“Gaming is rather macro-insensitive for some reason. People enjoy gaming,” said Mr. Huang during a conference call with investors and analysts. “Whether the economy is good or not, whether the oil price is high or not, people seem to enjoy gaming. […] Gaming is not something that people do once a month, like going out to a movie theater or something like that. People game every day, and the gamers that use our products are gaming every day.”

The CEO of NVIDIA was naturally talking about the success of the GeForce GTX lineup in the Q1 of the company’s fiscal 2017, but he perfectly indicated the behavior of those who buy gaming PCs with high-performance graphics cards and processors in general. These people spend regardless of global economic trends and they tend to get whatever is needed to hit their performance targets (i.e., framerate in their favorite games). While this means that companies like Intel, NVIDIA, AMD and others can enjoy great sales of their high-end products for gamers, it also means that they can predict demand for such parts and ensure that they are not in short supply. NVIDIA has been doing a very good job in the past few years in meeting demand for its GeForce GTX lineup, even though most high-end gamers want the next generation product yesterday. As for Intel, it either underestimated the popularity of its Core i7-6700K and Core i5-6600K CPUs early in their lifecycle, or simply could not produce a sufficient amount of chips it needed to satisfy its customers (Intel has always stated they are running at expected volume in our previous Price Check pieces).

Anyway, right now it looks like the unlocked Skylake-S processors are sold at their MSRPs and all the customers can get the chip they want. Keeping in mind that Intel’s next-generation CPUs slated for sometime in the future, code-named Kaby Lake, are set to be made using now well-proven 14 nm process technology, we wonder if history will repeat itself and the upcoming unlocked processors will/will not be in short supply. Nonetheless, we will keep monitoring the availability of unlocked CPUs.

Skylake-K Review: Core i7-6700K and Core i5-6600K – CPU Review

Comparison between the i7-6700K and i7-2600K in Bench – CPU Comparison

Overclocking Performance Mini-Test to 4.8 GHz – Overclocking

Skylake Architecture Analysis – Architecture

Non-K BCLK Overclocking is Being Removed – Overclocking Update

An Overclockable Core i3: The Intel Core i3-6100TE Review – Analysis of an Overclocked Core i3 CPU

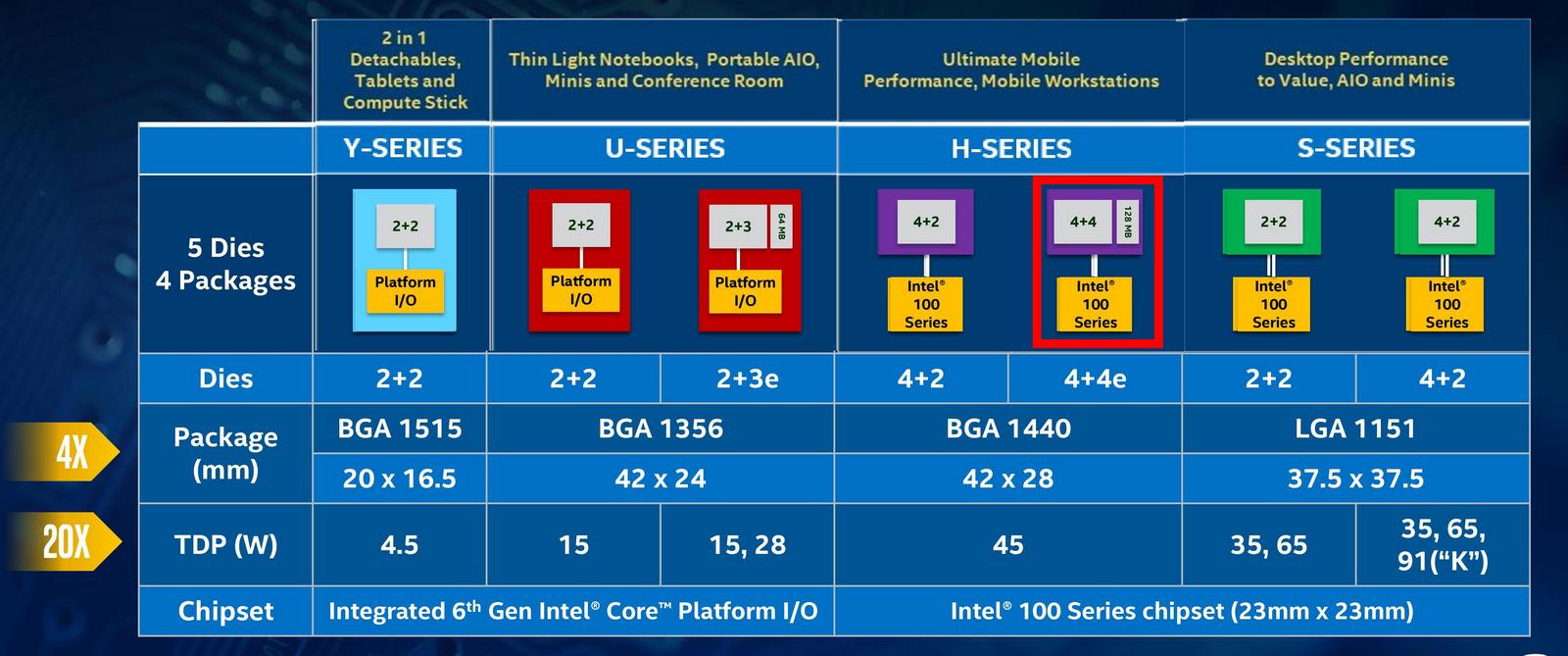

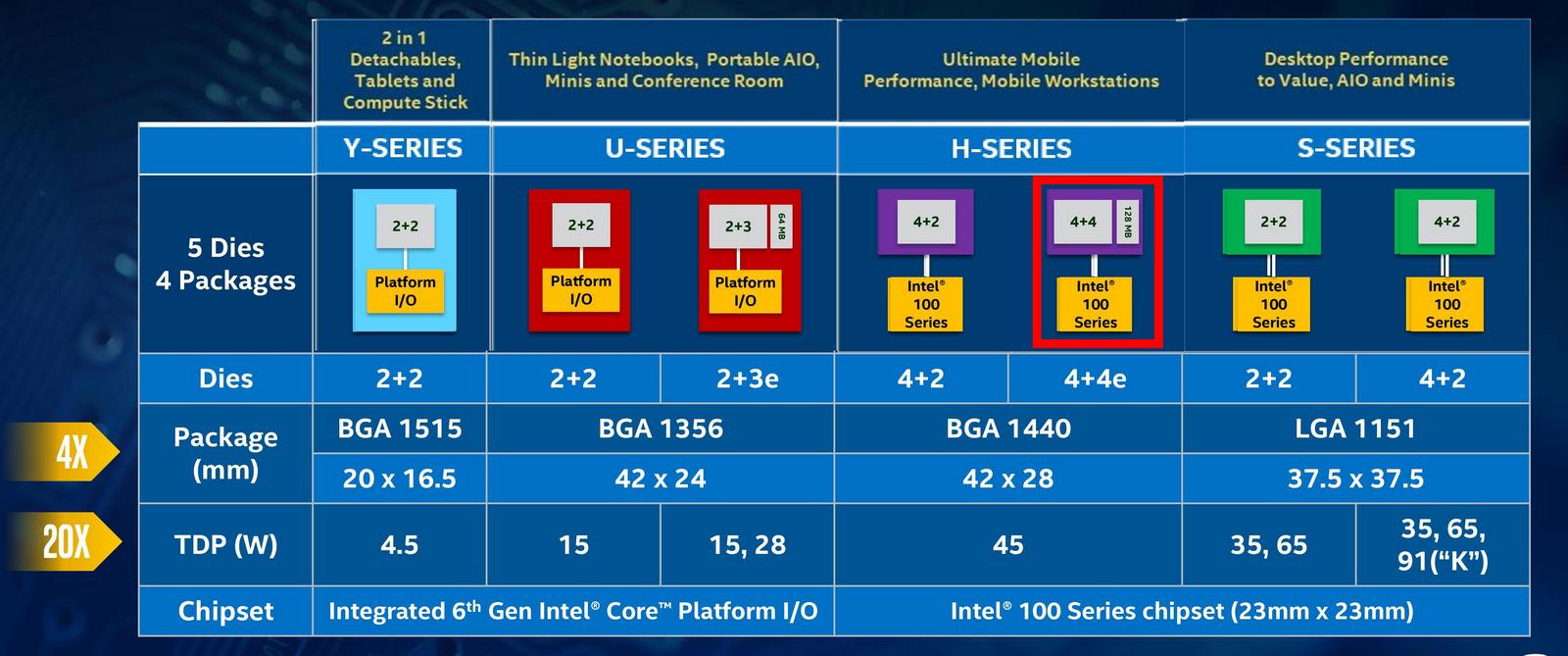

Intel has added three new microprocessors for embedded and highly-integrated applications into its lineup. The new CPUs are based on the Skylake microarchitecture and feature high-performance integrated graphics cores with an added eDRAM cache called Crystal Well. The new products should offer high performance in memory bandwidth applications due to Skylake’s updated 2nd generation cache architecture.

In red is the 4+4e die with 128MB eDRAM

The chips that Intel has added to its price list are the Core i7-6785R, the Core i5-6685R, and the Core i5-6585R. The new processors are designed to fit in all-in-one PCs, small form-factor and other types of highly-integrated PCs that can satisfy the 65W TDP over the mobile Crystal Well variants that run at 45W. The new desktop chips from Intel are based on the Skylake-H silicon in its most advanced configuration: with four general-purpose cores as well as the GT4e integrated graphics. Not all the specifications of the processors are known at this point, but we are talking about quad-core processors with Generation 9 Iris Pro graphics and 72 execution units (as well as 128 MB of eDRAM), a dual-channel DDR4-2133 memory controller, a PCI Express 3.0 interface and three display outputs. The power consumption of Intel’s new embedded products for desktops does not exceed 65 W, which is typical for R-series offerings, and offer a potential upgrade path by OEMs for any equivalent systems that used an equivalent Broadwell-based R-series processor.

Intel unveiled its Skylake-H silicon in its full glory earlier this year when it released its mobile Xeon E3 v5 processors with the Iris Pro Graphics P580.

Several makers of industrial computer modules (such as Congatec) already use chips like the Intel Xeon E3-1515M v5 for their products, which is why we know what they look like. The die of the Skylake-H processor looks rather long and the lion’s portion of its transistor budget was spent on the mammoth iGPU. The extra on package die is the eDRAM, and the silicon underneath the CPU is the chipset (it’s the Y/U series CPUs that have integrated chipsets).

| Comparison of Intel’s Embedded CPUs | |||||||||

| i7-6785R | i5-6685R | i5-6585R | i7-5775R | i5-5675R | i5-5575R | ||||

| Microarchitecture | Skylake | Broadwell | |||||||

| Cores/Threads | 4 / 8 | 4 / 4 | 4 / 4 | 4 / 8 | 4 / 4 | 4 / 4 | |||

| L2 Cache | 1 MB (256 KB × 4) | ||||||||

| L3 Cache | 8 MB | 6 MB | 6 MB | 4 MB | |||||

| eDRAM | 128 MB | 128 MB | |||||||

| CPU Frequency | default | 3.30 GHz | 3.20 GHz | 2.80 GHz | 3.30 GHz | 3.10 GHz | 2.80 GHz | ||

| maximum | 3.90 GHz | 3.80 GHz | 3.60 GHz | 3.80 GHz | 3.60 GHz | 3.30 GHz | |||

| GPU | Iris Pro 580 | Iris Pro 6200 | |||||||

| EUs | 72 | 48 | |||||||

| TDP | 65 W | 65 W | |||||||

| GPU Frequency | 350 MHz to 1150/1150/1100 MHz | 300 MHz to 1150/1100/1050 MHz | |||||||

| DRAM Support | DDR4-2133/1866 DDR3L-1600/1333 |

– DDR3L-1866/1600/1333 |

|||||||

| Packaging | FCBGA1440 | FCBGA1364 | |||||||

| Process Technology | 14 nm | ||||||||

| Price | $370 | $288 | $255 | $348 | $265 | $244 | |||

The new parts feature higher clock rates compared to the Broadwell processors, although slightly lower than their K series counterparts. The processors have a number of important architectural improvements which will affect the performance of these CPUs in real-world applications. It is interesting to note that Intel retained the full L3 cache size in its new R-series CPUs: in the Broadwell models part of the L3 was used for eDRAM tags, reducing their capacity by 2 MB, but the new Skylake parts are now in line with their i7 and i5 naming due to the way the eDRAM is implemented. This means that the i7-6785R has 8 MB of L3, similar to the i7-6700K, and the i5-6685R/6585R has 6 MB of L3, similar to the i5-6600K.

Intel’s Skylake processors feature an upgraded microarchitecture with better parallelism and improved IPC, which means better performance almost across-the-board. An important capability of Skylake is its Speed Shift technology, which can quickly increase frequency for a short amount of time in a bid to rapidly perform an operation (~1-3 milliseconds rather than 30-100 without Speed Shift), thus providing better user experience and ultimately saving power. Intel’s Speed Shift requires support by the operating system and right now Microsoft’s Windows 10 can take advantage of the technology in a bid to improve its responsiveness.

Another important aspect of Intel’s Skylake CPUs with high-end iGPUs is their eDRAM, which means the processors also gain the code name ‘Crystal Well’. The eDRAM for Skylake is different to that found in previous Crystal Well implementations: in the last generation, the eDRAM acted as a victim cache to the L3 cache, meaning that evicted cache lines from L3 would add up in the eDRAM and be quick for re-reading without having to access main memory. The downside to this is that data could not end up in eDRAM without being used first, giving initial data read latencies the same performance as previous processors. Ultimately this is still good for graphics and gaming, where textures are re-read from memory frequently. The new arrangement for the eDRAM in these Skylake processors has placed the eDRAM in a different part of the chain, between the System Agent and the DDR memory. This means that the eDRAM acts as a DRAM buffer, with 50 GBps bandwidth in each direction to the LLC, but is also accessible for early reads/writes by any device that needs memory access through the system agent (i.e. anything through PCIe). Previously this was not possible, but now it means that Skylake’s eDRAM implementation should offer a speedup in many more scenarios that before.

The final noteworthy improvement of the Skylake processors compared to previous-generation offerings is revamped graphics core as well as increased amount of execution units. Based on our findings last year, real-world performance of Intel’s high-end Iris Pro 6200 graphics core (Broadwell’s top iGPU) is higher than that of entry-level discrete graphics cards. Meanwhile, the highest-performing GT4e graphics core of Intel Skylake contains 72 EUs, up from 48 in the case of the Broadwell. Compute performance of Intel’s contemporary top-of-the-range iGPU (Iris Pro 580) is around 1.1 TFLOPS depending on its frequency, so, this one should be tangibly faster than its predecessor. Last, but not least, Skylake’s iGPU has a revamped multimedia engine, which supports hardware decoding and encoding of UHD videos using HEVC or VP9 codecs.

Intel’s new Core i7-6785R, Core i5-6685R, and Core i5-6585R are already available at a tray price of $370, $288 and $255 respectively. Partners of the chipmaker will likely use the new processors to build their new systems in the coming months.

Image Sources: Congatec, Intel’s IDF presentations.

Intel has added three new microprocessors for embedded and highly-integrated applications into its lineup. The new CPUs are based on the Skylake microarchitecture and feature high-performance integrated graphics cores with an added eDRAM cache called Crystal Well. The new products should offer high performance in memory bandwidth applications due to Skylake’s updated 2nd generation cache architecture.

In red is the 4+4e die with 128MB eDRAM

The chips that Intel has added to its price list are the Core i7-6785R, the Core i5-6685R, and the Core i5-6585R. The new processors are designed to fit in all-in-one PCs, small form-factor and other types of highly-integrated PCs that can satisfy the 65W TDP over the mobile Crystal Well variants that run at 45W. The new desktop chips from Intel are based on the Skylake-H silicon in its most advanced configuration: with four general-purpose cores as well as the GT4e integrated graphics. Not all the specifications of the processors are known at this point, but we are talking about quad-core processors with Generation 9 Iris Pro graphics and 72 execution units (as well as 128 MB of eDRAM), a dual-channel DDR4-2133 memory controller, a PCI Express 3.0 interface and three display outputs. The power consumption of Intel’s new embedded products for desktops does not exceed 65 W, which is typical for R-series offerings, and offer a potential upgrade path by OEMs for any equivalent systems that used an equivalent Broadwell-based R-series processor.

Intel unveiled its Skylake-H silicon in its full glory earlier this year when it released its mobile Xeon E3 v5 processors with the Iris Pro Graphics P580.

Several makers of industrial computer modules (such as Congatec) already use chips like the Intel Xeon E3-1515M v5 for their products, which is why we know what they look like. The die of the Skylake-H processor looks rather long and the lion’s portion of its transistor budget was spent on the mammoth iGPU. The extra on package die is the eDRAM, and the silicon underneath the CPU is the chipset (it’s the Y/U series CPUs that have integrated chipsets).

| Comparison of Intel’s Embedded CPUs | |||||||||

| i7-6785R | i5-6685R | i5-6585R | i7-5775R | i5-5675R | i5-5575R | ||||

| Microarchitecture | Skylake | Broadwell | |||||||

| Cores/Threads | 4 / 8 | 4 / 4 | 4 / 4 | 4 / 8 | 4 / 4 | 4 / 4 | |||

| L2 Cache | 1 MB (256 KB × 4) | ||||||||

| L3 Cache | 8 MB | 6 MB | 6 MB | 4 MB | |||||

| eDRAM | 128 MB | 128 MB | |||||||

| CPU Frequency | default | 3.30 GHz | 3.20 GHz | 2.80 GHz | 3.30 GHz | 3.10 GHz | 2.80 GHz | ||

| maximum | 3.90 GHz | 3.80 GHz | 3.60 GHz | 3.80 GHz | 3.60 GHz | 3.30 GHz | |||

| GPU | Iris Pro 580 | Iris Pro 6200 | |||||||

| EUs | 72 | 48 | |||||||

| TDP | 65 W | 65 W | |||||||

| GPU Frequency | 350 MHz to 1150/1150/1100 MHz | 300 MHz to 1150/1100/1050 MHz | |||||||

| DRAM Support | DDR4-2133/1866 DDR3L-1600/1333 |

– DDR3L-1866/1600/1333 |

|||||||

| Packaging | FCBGA1440 | FCBGA1364 | |||||||

| Process Technology | 14 nm | ||||||||

| Price | $370 | $288 | $255 | $348 | $265 | $244 | |||

The new parts feature higher clock rates compared to the Broadwell processors, although slightly lower than their K series counterparts. The processors have a number of important architectural improvements which will affect the performance of these CPUs in real-world applications. It is interesting to note that Intel retained the full L3 cache size in its new R-series CPUs: in the Broadwell models part of the L3 was used for eDRAM tags, reducing their capacity by 2 MB, but the new Skylake parts are now in line with their i7 and i5 naming due to the way the eDRAM is implemented. This means that the i7-6785R has 8 MB of L3, similar to the i7-6700K, and the i5-6685R/6585R has 6 MB of L3, similar to the i5-6600K.

Intel’s Skylake processors feature an upgraded microarchitecture with better parallelism and improved IPC, which means better performance almost across-the-board. An important capability of Skylake is its Speed Shift technology, which can quickly increase frequency for a short amount of time in a bid to rapidly perform an operation (~1-3 milliseconds rather than 30-100 without Speed Shift), thus providing better user experience and ultimately saving power. Intel’s Speed Shift requires support by the operating system and right now Microsoft’s Windows 10 can take advantage of the technology in a bid to improve its responsiveness.

Another important aspect of Intel’s Skylake CPUs with high-end iGPUs is their eDRAM, which means the processors also gain the code name ‘Crystal Well’. The eDRAM for Skylake is different to that found in previous Crystal Well implementations: in the last generation, the eDRAM acted as a victim cache to the L3 cache, meaning that evicted cache lines from L3 would add up in the eDRAM and be quick for re-reading without having to access main memory. The downside to this is that data could not end up in eDRAM without being used first, giving initial data read latencies the same performance as previous processors. Ultimately this is still good for graphics and gaming, where textures are re-read from memory frequently. The new arrangement for the eDRAM in these Skylake processors has placed the eDRAM in a different part of the chain, between the System Agent and the DDR memory. This means that the eDRAM acts as a DRAM buffer, with 50 GBps bandwidth in each direction to the LLC, but is also accessible for early reads/writes by any device that needs memory access through the system agent (i.e. anything through PCIe). Previously this was not possible, but now it means that Skylake’s eDRAM implementation should offer a speedup in many more scenarios that before.

The final noteworthy improvement of the Skylake processors compared to previous-generation offerings is revamped graphics core as well as increased amount of execution units. Based on our findings last year, real-world performance of Intel’s high-end Iris Pro 6200 graphics core (Broadwell’s top iGPU) is higher than that of entry-level discrete graphics cards. Meanwhile, the highest-performing GT4e graphics core of Intel Skylake contains 72 EUs, up from 48 in the case of the Broadwell. Compute performance of Intel’s contemporary top-of-the-range iGPU (Iris Pro 580) is around 1.1 TFLOPS depending on its frequency, so, this one should be tangibly faster than its predecessor. Last, but not least, Skylake’s iGPU has a revamped multimedia engine, which supports hardware decoding and encoding of UHD videos using HEVC or VP9 codecs.

Intel’s new Core i7-6785R, Core i5-6685R, and Core i5-6585R are already available at a tray price of $370, $288 and $255 respectively. Partners of the chipmaker will likely use the new processors to build their new systems in the coming months.

Image Sources: Congatec, Intel’s IDF presentations.

AMD announced their first quarter results from fiscal year 2016. AMD has certainly been struggling of late, but CEO Lisa Su made the announcement that AMD had made a joint-venture with THATIC for x86 processor development for the Chinese market. AMD will receive $52 million immediately and the total agreement is for $293 million, plus future royalties. This is a significant agreement for AMD, and licensing their IP is one of the ways they hope to get back to profitability.

Looking at the overall quarter, AMD had revenues of $832 million, which is down a significant 19% from last year. But the good news for AMD is that their gross margin is up to 32%, an increase over last quarter and having it come back to the same level as a year ago. AMD reported an operating loss of $68 million for the quarter, which is an improvement over the $137 million loss last year. The net loss for the quarter was $109 million, or $0.14 per share, which is once again an improvement over last year’s $180 million loss, or $0.23 per share.

| AMD Q1 2016 Financial Results (GAAP) | |||||

| Q1’2016 | Q4’2015 | Q1’2015 | |||

| Revenue | $832M | $958M | $1030M | ||

| Gross Margin | 32% | 30% | 32% | ||

| Operating Income | -$68M | -$49M | -$137M | ||

| Net Income | -$109M | -$102M | -$180M | ||

| Earnings Per Share | -$0.14 | -$0.13 | -$0.23 | ||

AMD also reports non-GAAP results, which exclude restructuring costs and stock-based compensation. On a non-GAAP basis, AMD had an operating loss of $55 million, compared to a $30 million loss last year where they had high restructuring charges. Gross margin came in at the same 32%, and there was a net loss of $96 million, or $0.12 per share, compared to a net loss of $73 million, or $0.09 per share last year.

| AMD Q1 2016 Financial Results (Non-GAAP) | |||||

| Q1’2016 | Q4’2015 | Q1’2015 | |||

| Revenue | $832M | $958M | $1030M | ||

| Gross Margin | 32% | 30% | 32% | ||

| Operating Income | -$55M | -$39M | -$30M | ||

| Net Income | -$96M | -$79M | -$73M | ||

| Earnings Per Share | -$0.12 | -$0.10 | -$0.09 | ||

The Computing and Graphics segment is still the largest part of AMD, and for this quarter they had revenue of $460 million. That is a drop sequentially of 2%, and a year-over-year drop of 14%, but AMD improved their operating loss for this segment, with a loss of $70 million for the quarter. This is an improvement over the $99 million loss last quarter, and an improvement over the $75 million loss a year ago. The revenue drop from last quarter was attributed to a drop in desktop processor sales, and the annual drop is due to a decline in notebook processor sales. Lowered operating expenses were the reason for the better operating loss levels, but both desktop and notebook processors are seeing a decrease in average selling price for AMD. GPU sales also dropped average selling price compared to last quarter, but increase year-over-year with higher channel and professional GPU prices.

| AMD Q1 2016 Computing and Graphics | |||||

| Q1’2016 | Q4’2015 | Q1’2015 | |||

| Revenue | $460M | $470M | $532M | ||

| Operating Income | -$70M | -$99M | -$75M | ||

The Enterprise, Embedded, and Semi-Custom segment had revenue of $372 million for the first quarter of this year, which is down 24% from last quarter and 25% from last year. This group is profitable though, although just slightly this quarter, with an operating income of $16 million for the quarter. This compares to a $45 million income in Q1 2015 though, which is a big drop when AMD’s already cutting it pretty close. AMD attributes the revenue drop to lower sales of semi-custom SoCs, of which a big market is consoles. It makes sense that as the consoles mature, sales will trail off, but AMD did well to get inside both the PlayStation 4 and Xbox One on this round of consoles, since both have been selling well compared to the previous generation. The decrease in operating income due to lower sales and higher R&D spending, but was offset by a $7 million IP licensing deal.

| AMD Q4 2015 Enterprise, Embedded, and Semi-Custom | |||||

| Q1’2016 | Q4’2015 | Q1’2015 | |||

| Revenue | $372M | $488M | $498M | ||

| Operating Income | $16M | $59M | $45M | ||

The All Other category had an operating loss of $14 million for the quarter, compared to a $107 million loss last year. That is because AMD had some large restructuring charges on the books last year.

Unsurprisingly, AMD is still sorting out their future, and their results reflect that. They have had a pretty large processing disadvantage compared to Intel for a long time now, and later this year they will finally start shipping on 14 nm nodes, but it is the deals for IP licensing which bring in constant revenue without the associated costs of revenue which are the big news this quarter. With rumours of updated consoles, they may also get a bump in their semi-custom SoC if and when that happens. Looking to next quarter, AMD is expecting revenues to come in 15% higher, plus or minus 3%.

Source: AMD Investor Relations