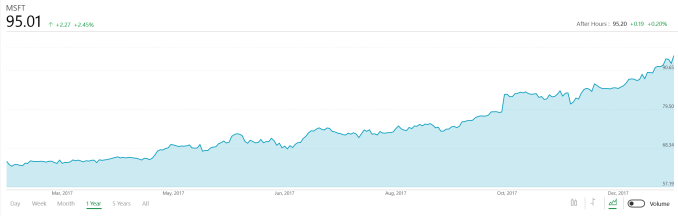

This afternoon, Microsoft announced their earnings for the second quarter of their 2018 fiscal year. The company had revenues of $28.9 billion for the quarter, which is up 12% from a year ago, and was driven by strong growth in their business offerings and cloud revenue. Gross margin for the quarter was 62%, which is flat compared to Q2 2017. Operating income was $8.7 billion for the quarter, which was up 10% year-over-year, but Microsoft is taking a $13.8 billion charge on deemed repatriation of deferred foreign income, so for this quarter, in terms of GAAP results, they are reporting a net loss of $6.3 billion, which results in a loss per share of $0.82. Excluding that charge, net income would have been up 20% to $7.5 billion.

| Microsoft Q2 2018 Financial Results (GAAP) |

| |

Q2’2018 |

Q1’2018 |

Q2’2017 |

| Revenue (in Billions USD) |

$28.918 |

$24.538 |

$25.826 |

| Operating Income (in Billions USD) |

$8.679 |

$7.708 |

$7.905 |

| Gross Margin (in Billions USD) |

$17.854 |

$16.260 |

$15.925 |

| Margins |

61.7% |

66.3% |

61.7% |

| Net Income (in Billions USD) |

-$6.302 |

$6.576 |

$6.267 |

| Basic Earnings per Share (in USD) |

-$0.82 |

$0.85 |

$0.81 |

Microsoft’s More Personal Computing (MPC) division is not the star of the show anymore, but it still brings in more revenue than the company’s other divisions. For the quarter, MPC had revenues up 2% to $12.17 billion, with the growth attributed to gaming and search, although further losses from their failed phone efforts accounted for 2% of revenue loss. The MPC segment had $2.51 billion in operating income for the quarter, which was down 2% from a year ago. Margins for Surface and search were up, but gaming was down due to the expenses related to the launch of the Xbox One X.

Windows OEM Pro revenue was up 11% for the quarter, which Microsoft stated is a couple percentage points ahead of the commercial PC market, which indicates that there’s some growth on the commercial side right now in terms of PC sales. OEM non-Pro declined 5% though, which is a larger decline than the personal PC market. Search revenue was up 15% for the quarter, with both more revenue per-search, and more search volume.

On the gaming side, revenue was up 8% to $3.92 billion, with Xbox hardware revenue up 14% from the launch of the Xbox One X. Xbox software and services grew 4%, with more digital sales in the picture. Microsoft no longer reports Xbox console sales numbers, but they did state that active users of Xbox Live has grown 7% to 59 million, but that’s across their ecosystem and not specific to the console hardware.

Surface didn’t have a spectacular quarter though, with revenue basically flat year-over-year at $1.335 billion. Microsoft’s average selling price was up, but there was a decline in unit sales compared to the same point last year, which is a bit surprising since the company has refreshed it’s product lineup this year, where as a year ago it was still the same devices as launched in November 2015.

Productivity and Business Processes, which includes Office 365, commercial, and consumer, along with Dynamics, and LinkedIn, continues to show strong growth for the company. For this quarter, revenues were up 25% to $8.95 billion. LinkedIn accounted for 15 percentage points of revenue growth for this segment. Operating income was up 9% to $3.34 billion. Office 365 continues to be a huge success, although it’s certainly cannibalizing some of Microsoft’s old business. Office 365 commercial seats were up 30% for the quarter, compared to Q2 2017, and revenue from commercial seats was up 41%. However, the traditional Office sales declined 16% due to this growth in the subscription model. On the consumer side, Office consumer revenue was up 12%, and they now have 29.2 million subscribers. Dynamics revenue was up 10%, with Dynamics 365 up 67%. LinkedIn contributed revenues of $1.3 billion, although that acquisition is also responsible for 33% of their expenses for this segment.

Intelligent Cloud, which includes server and cloud products, as well as enterprise services, had revenues for the quarter of $7.8 billion, which is up 15% from a year ago. Operating income was $2.83 billion, up 24%. Server products continued to grow, up 4% from a year ago, but Azure is the key to this segment, with Azure revenue up 98% from a year ago, which continues a trend of 90+% revenue growth for the last five quarters. Azure compute usage more than doubled over the last year.

| Microsoft Q2 2018 Financial Results (GAAP) |

| |

Productivity and Business Processes |

Intelligent Cloud |

More Personal Computing |

| Revenue (in Billions USD) |

$8.95 |

$7.80 |

$12.17 |

| Operating Income (in Billions USD) |

$3.34 |

$2.83 |

$2.51 |

| Revenue Change YoY |

+25%, +24% CC |

+15%, +15% CC |

+2%, +2% CC |

| Operating Income Change YoY |

+9%, +10% CC |

+24%, +24% CC |

-2%, -2% CC |

Despite a large charge for taxes this quarter, it’s clear that Microsoft’s cloud efforts are starting to really pay dividends. For Q3, Microsoft is expecting revenues in the $25.25 to $25.95 billion range.

Source: Microsoft Investor Relations