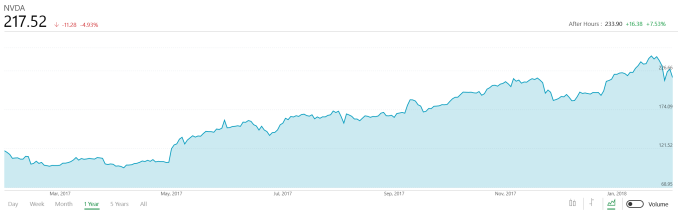

This afternoon NVIDIA announced yet another record quarter, with revenues of $2.91 billion, which is up 34% from a year ago. Gross margin was 61.9%, and operating income was up 46% to $1.07 billion. Net income for the quarter was $1.12 billion, up 71% from a year ago, which provided diluted earnings per share of $1.78.

| NVIDIA Q4 2018 Financial Results (GAAP) |

| |

Q4’2018 |

Q3’2018 |

Q4’2017 |

Q/Q |

Y/Y |

| Revenue |

$2911M |

$2636M |

$2173M |

+10% |

+34% |

| Gross Margin |

61.9% |

59.5% |

60.0% |

+2.4% |

+1.9% |

| Operating Income |

$1073M |

$895M |

$733M |

+20% |

+46% |

| Net Income |

$1118M |

$838M |

$655M |

+33% |

+71% |

| EPS |

$1.78 |

$1.33 |

$0.99 |

+34% |

+80% |

For their 2018 fiscal year, NVIDIA racked up $9.71 billion in revenue, which is up 41% from a year ago. Earnings per share for the year were $4.82, up 88%.

NVIDIA has kind of hit a magic sweet spot, where they had been diversifying into growing markets, but have found themselves also swept up in the GPU fed craze of cryptocurrency, feeding their core business as well.

Gaming, which is their GeForce lineup, had revenues for the quarter of $1.74 billion, up almost $400 million from a year ago. But for the entire fiscal year, they haven’t even refreshed their lineup, although the Pascal series of GPUs have certainly been strong in terms of performance and efficiency. But you’d be lucky to find any in stock thanks to the copious number of GPUs purchased for mining coins. It’s not been ideal for gamers, but for NVIDIA’s R&D, and their investors, it’s been welcome news.

Professional Visualization was also up about 13% to $254 million. Growth here was attributed to the ultra-high-end and high-end desktop workstations, such as the Quadro GP100 launched earlier in the fiscal year.

NVIDIA’s foray into the datacenter is also paying off with substantial growth. Datacenter includes Tesla, GRID, and DGX systems, and for the quarter, NVIDIA saw revenues of $606 million, which are up 105% from a year ago.

Automotive was up a more modest 3% to $132 million, and we’ve seen NVIDIA get some big design wins with large automotive companies with their DRIVE platforms.

Automotive is powered by Tegra, and including the automotive sales, Tegra brought in $450 million this quarter, and the very popular Nintendo Switch is likely a nice chunk of that.

OEM and IP was $180 million for the quarter, which is up about 2.2%, and NVIDIA stated their licensing agreement with Intel concluded in the first quarter of fiscal year 2018.

NVIDIA Quarterly Revenue Comparison (GAAP)

($ in millions) |

| In millions |

Q4’2018 |

Q3’2018 |

Q4’2017 |

Q/Q |

Y/Y |

| Gaming |

$1739 |

$1561 |

$1348 |

+11% |

+29% |

| Professional Visualization |

$254 |

$239 |

$225 |

+6% |

+13% |

| Datacenter |

$606 |

$501 |

$296 |

+21% |

+105% |

| Automotive |

$132 |

$144 |

$128 |

-8% |

+3% |

| OEM & IP |

$180 |

$191 |

$176 |

-6% |

+2% |

For Q1 2019, NVIDIA is forecasting revenues of $2.9 billion, plus or minus 2%.

Source: NVIDIA Investor Relations